Distributors often operate with much lower profit margins than manufacturers, which makes optimizing efficiency even more crucial. Effective management of sales, inventory, and suppliers can be the key to unlocking significant growth, potentially transforming a modest 5% growth rate into a substantial 25%. But how can distributors achieve this? The answer lies in the implementation of the right technology solutions.

By leveraging advanced tech tools, distributors can streamline operations, reduce costs, and gain greater visibility into their supply chains. This enables them to make data-driven decisions that improve customer satisfaction, optimize inventory levels, and enhance supplier relationships—all contributing to stronger margins and more robust growth.

Distributors operate on relatively low margins relative to manufacturers.

Better management of sales, inventory and suppliers could mean the difference between a 5% growth rate or 25%. But how can management achieve this? Through the right tech solutions.

Distribution Strategy Group Founder, Ian Heller sat down with Resolve’s Giovanni Bryden, White Cup’s Kristen Thom and Infor’s Steve Levy to discuss various ways distributors can lean on technology to maximize sales and cash flow.

A few questions covered were as follows:

- What opportunities do you see to improve sales performance?

- Happy employees, spur happy customers, how can distributors support their employees through tools and best practices to create a better customer experience?

- What tools help the customers themselves have a better B2B customer experience?

- As baby boomers retire and a younger generation enters the workforce, how does this shift impact a distribution business?

- What changes (i.e., education, documenting business processes, etc.) does a distributor need to make to be ready to understand the tech they need to differentiate themselves in the marketplace?

To listen to the full conversation, sign up to watch the video!

1. Improve sales performance by offering net terms

Learn More: Get your guide to net terms

As previously mentioned, distributors operate on tight margins so payment reminders and getting paid on time is paramount. The perfect PNL falls by the wayside - supply chains can slow down or perhaps you issue a credit note on an invoice that you are expecting to get paid on because that leg on the sofa breaks. These are just some of the realities distributors face.

Having a tight margin, means you need tighter control over how accounts receivables is turned into cash, offering net terms with a cash advance is one solution. The most successful distributors are thinking about the bottom line but are also thinking about how to fuel growth, how do I accelerate the cash I do control, and how do I make sure I have a healthy pool of capital to stay resilient in a downturn and anything else that can happen in the course of the year.

2. Find better tooling and data for your own employees

“A happy employee has an optimized solution that is personalized to them, gives them the right information at the right time to do their job. “- Steve Levy, Infor

There are many great tools out there but finding the right tool (whether financial tool or automation tool) or that gives your employees the data they need to do their job is another story. Kirsten Tom mentions that the “tools should focus on the end user - sales person or a warehouse manager. It’s not about more data, it’s about data they need to get the job done.”

Gio takes it one step further by discussing the idea of breaking down data silos - rather than providing employees with tools that share more data, one should focus on getting the right data and combining it to create a full picture.

Think about one silo which is all your orders and another is a list of suppliers and their credit lines. You can run a pivot table on Excel but your data is not going to be available in real time, nor will it be readable to a salesperson who is interested in seeing which suppliers still have a credit line to use up so they can meet their sales quota. A solution that can clearly present tailored data and information to employees so they can succeed at their job is key - Resolve offers a buy now pay later solution to give your customers access to a credit line and allow your salespeople to offer more incentives to new and existing suppliers and meet their quotas!

3. Focus on putting your customers first

“You can put yourself in a better position by acting as a trusted advisor, it’s not just transactional interaction.” - Kristen Thom, White Cup

A new trend emerged before COVID, traditional B2B customers started developing B2C expectations - long gone are the days of paper invoices and cutting POs, now customers are expecting flexible invoicing and more meaningful interactions (building your brand as a trusted advisor).

“We see ourselves as a solution to counterpoint Factoring.” - Gio Bryden, Resolve

You lose control of the customer experience with Factoring. You don’t want customers to make a choice between a good experience and opening up cash flow. Transparency on fees and opportunities to offer flexible payment terms because things don’t always go as planned (i.e. the cost of a container just doubled) is key to the long term customer relationship. Whenever you have the opportunity to put yourself in a position of being a trusted business partner for your customers and their customers as well, our advice is to do it!

Finding innovative solutions that will help you become a better partner and create an ecosystem of trust, is what will help you grow.

4. Preparing for the generational shift through BNPL process improvements

To keep this short, distributors, wholesalers and manufacturers are seeing a generational shift - their 40 something year old child is taking over the business. What type of changes do we see this sparking? A shift to process improvements, prompting digital transformation and moving away from paper processing and record keeping to name a few.

We’ve said this before but we’ll say this again, this shift is catalyzed as people want their B2B payments and transactions to be as seamless as B2C and we need to meet that challenge.

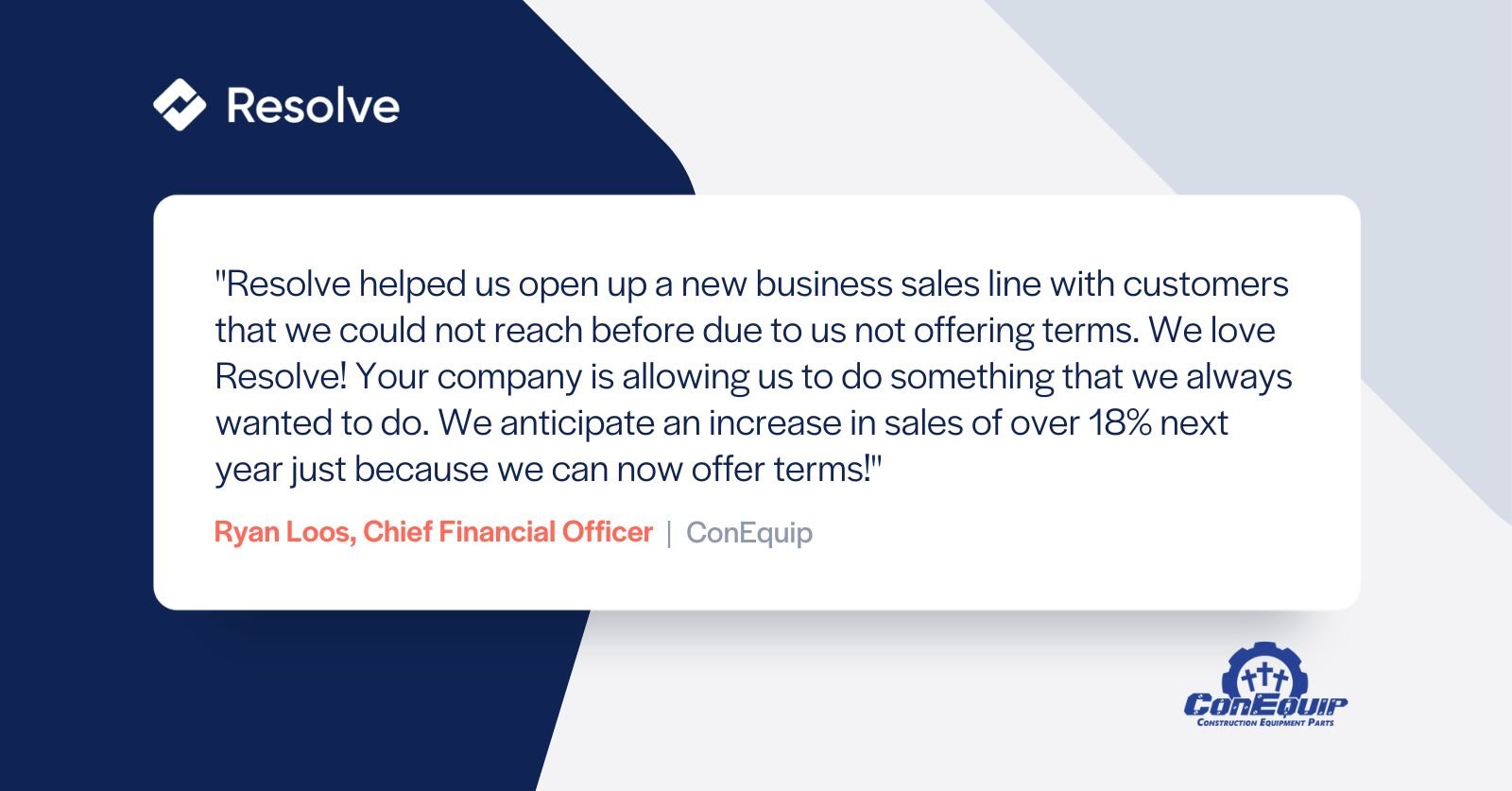

Finding the right tech solutions that support this catalyzation is key. As again it boils down to what the customer wants, and the younger generation is the new customer. ConEquip is a great example of this - although they don’t take orders online (despite having $52 billion in inventory) they have focused on building out their processes - offering net terms to customers is a process improvement. Now they can serve customers who want the same payment terms available on Amazon - buy now and pay later, but in the B2B space. By doing so they have grown 30% YoY.

Being ready to adapt quickly is key to success as a generational shift is inevitable and infinite.

5. Think long and hard about your business strategy

You know you want to increase the value of your company, but you are not sure of what tech can help you get there. “The first step is to get some clarity on your strategy and objectives,” said Steve Levy from Enterprise Architecture. You can challenge your tech partners on the nuisances of how to achieve your objective, but first you need to have that objective, so don’t focus on the requirements.

Kristen Thom notes that “you will not always know the most efficient way from point A to B.” This is exactly why it is important to partner with a company that has a handful of experts and dependable customer service team to work with you towards your objectives. Complete your due diligence by reading company reviews or customer stories to see how they have helped other distributors.

Finally, Gio solidifies the point about customer stories or as they like to call it, social proof. “The distributors I work with take word of mouth very seriously and it’s hard to be an early adopter - it’s both scary and expensive.” This is why having a strategy again is important, to have something to fall back on - why are we doing this and how do we see this driving a transformational business outcome. Finding the right partner to work with you to get there is the next step.

What’s next? Learn more about how net terms can grow your bottom line.

Think about what was discussed and how it resonated with you and your business goal. If you are ready to learn more about how Resolve will act as your trusted partner to help you turn dollars into profit and increase sales, book a demo with our payment specialists.