2x

increase in buyer

purchasing power

30-60%

days faster

payment

50%

less time managing

receivables

9x

faster

credit checks

How does Resolve work?

Resolve runs smart customer credit checks

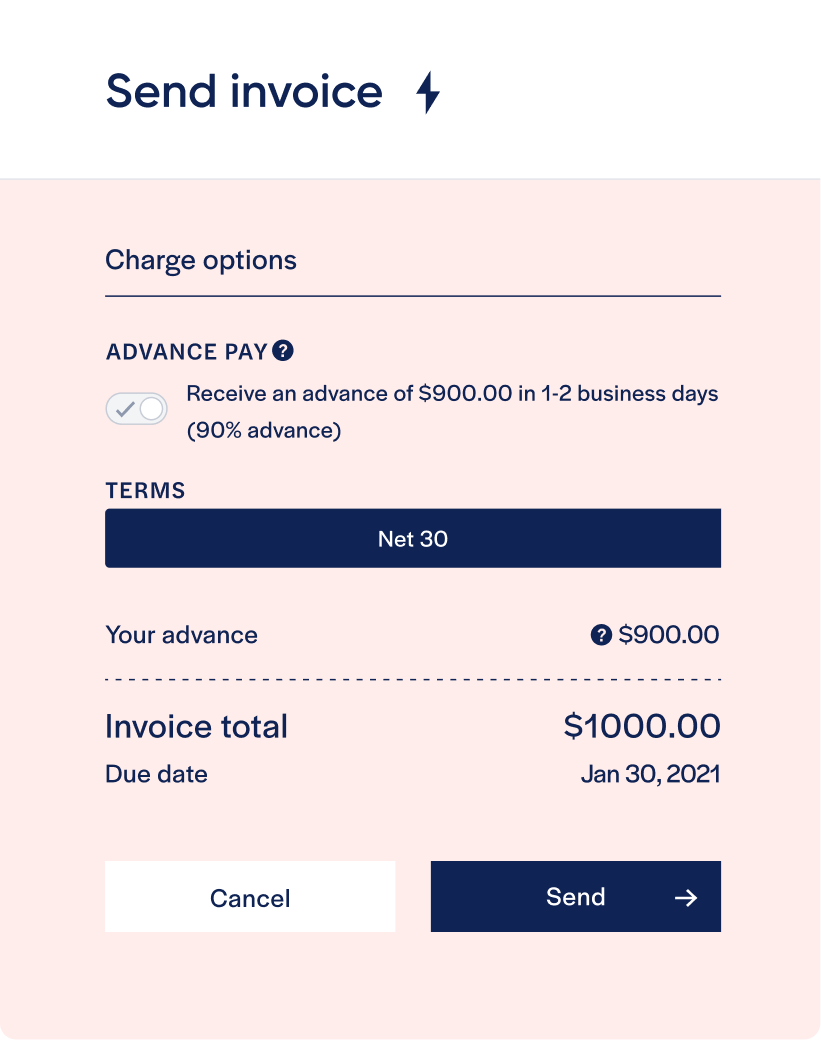

Depending on the results, your customer's invoices will qualify for Advance Pay. This means up to 100% paid upfront. Note that higher risk customers may qualify for 75% or 50%.

Offer net terms to your customers

Resolve fees are 2.61% on 30 day net terms. Depending on your customers expectations you can absorb this fee into your pricing - or pass it on to them.

We'll chase payments & manage collections

Resolve is like your 'credit team' or Accounts Receivables team on tap. We send payment reminders and can help chase any late payments.

Offer net terms for traditional or eCommerce sales

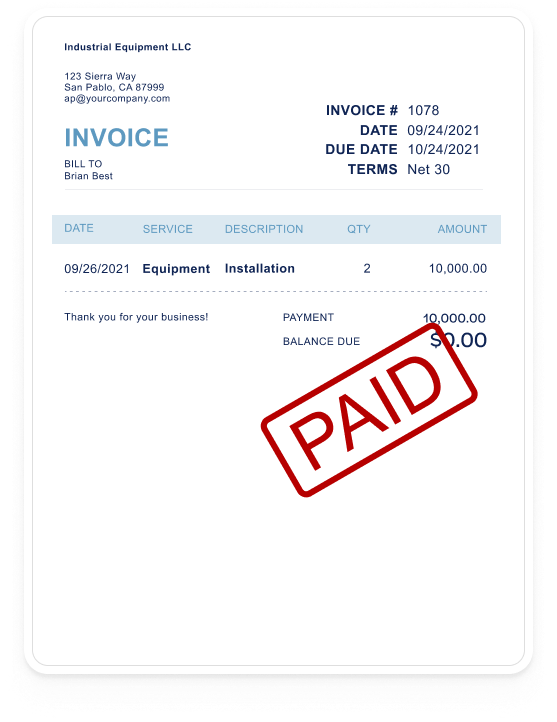

Invoice management

Resolve integrates with QuickBooks Online and lets you send the net terms invoices from our system - while keeping your QuickBooks Online records straight.

Online checkout

Resolve's Checkout Extension for Magento and WooCommerce means you can offer customers net terms at checkout, all from within your store online.

“Resolve has had a ripple effect on my business. Improved financial velocity started improving motivation and we're therefore getting more customers. Everything's growing."

“Resolve allowed us to expand & enter new markets. We could now take larger orders on with net terms, which we previously had to turn down."

.png)