2x

increase in buyer

purchasing power

30-60%

days faster

payment

50%

less time managing

receivables

9x

faster

credit checks

Automate and scale your AR

Improve cash flow

Unlock cash flow for growth. Receive an advance cash payment on approved invoices of up to 90%.

Offer B2B payment terms

Our risk-free net terms give your customers more time to pay, while you get paid upfront.

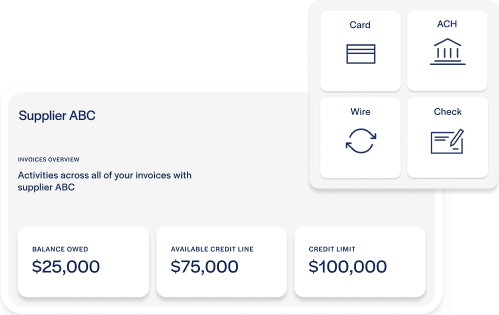

Offer different payment options

Our payments portal gives customers more payment options: credit card, ACH, wire transfers, and checks.

We improve B2B payments for 10,000+ businesses

Offer net terms without impacting cash flow

QuickBooks Online & automated bookkeeping

- Save time and energy reconciling your books.

- Better traceability between invoices, payments and payouts.

- Keep your financials up to date with less effort.

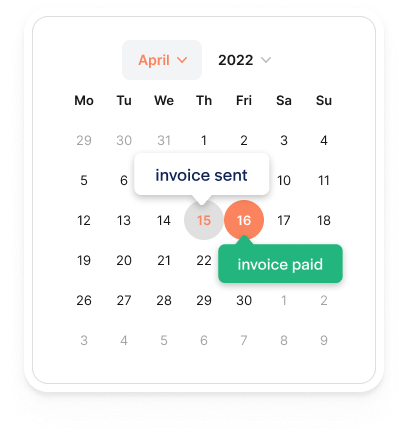

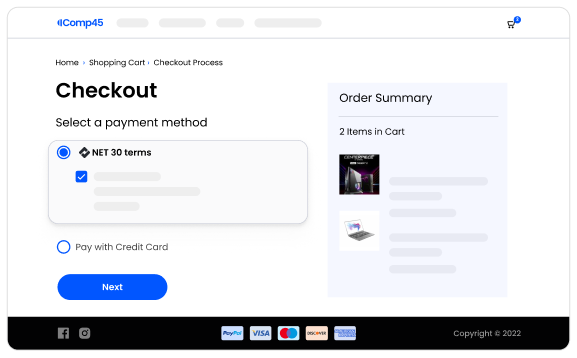

Net terms at ecommerce checkout

Resolve's B2B payments features

B2B payment portal

Improve your customer's experience by giving them more ways to pay with a professional, company-branded, billing experience.

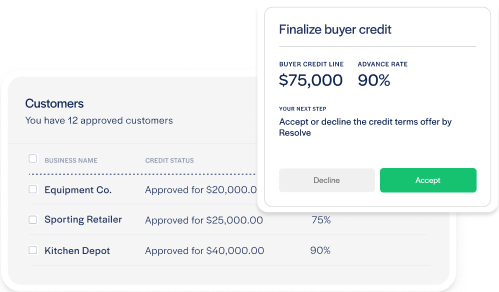

AR & credit dashboard

Understand and reduce risk by proactively managing AR and maximize your customer’s credit lines.

QuickBooks auto-bookkeeping

Save time on manual reconciliations. Resolve automatically records and syncs all transactions to QuickBooks.

Advance pay

Don't lose the sale. Access fast and reliable financial assessments of your customer's credit within hours.

Smart credit engine

A white-label payment portal that gives your customers more ways to pay.

Ecommerce checkout extension

Give online customers the option to apply for net terms at checkout. Approvals are granted within hours.

Resolve streamlines B2B payments on both sides

For your customers

Company-branded payment portal

Offer your own branded and professional payments & billing experience to improve your customer's experience.

- Secure online login and access

- One dashboard to view all invoices, credit lines, and history.

- Easy online payment options: ACH, transfer, or credit card.

For your business

Accounts receivables dashboard

Strategically unlock cash flow and make smarter business decisions. Utilize larger credit lines, export payment summaries, manage credit & AR processes.

- Easily view all outstanding AR.

- Access credit line summaries & advance rates for all customers.

- Export and sync payment history.

“Resolve has had a ripple effect on my business. Improved financial velocity started improving motivation and we're therefore getting more customers. Everything's growing."

“Resolve allowed us to expand & enter new markets. We could now take larger orders on with net terms, which we previously had to turn down."

“Our business customers used to go through a lengthy multi-week credit approval process & cumbersome payments experience. Resolve means we can now deliver a frictionless, customer-first approach."

.webp)

.png)