3x

more

revenue

20%

increased

profit margins

50%

repeat

buyers

1.5x

average

order size

How B2B buy now pay later helps you increase revenue

Increase online B2B sales

Offering buy now pay later and net terms options to business buyers is proven to increase sales volume and customer retention.

Improve your cash flow

Get paid up front for approved purchases and invoices. Some purchases up to $25,000 may qualify for instant approvals.

Reduce your financial risk

We take on the risk of offering net terms with smart credit checks and enterprise grade fraud prevention.

Resolve integrates directly into your ecommerce and accounting stack

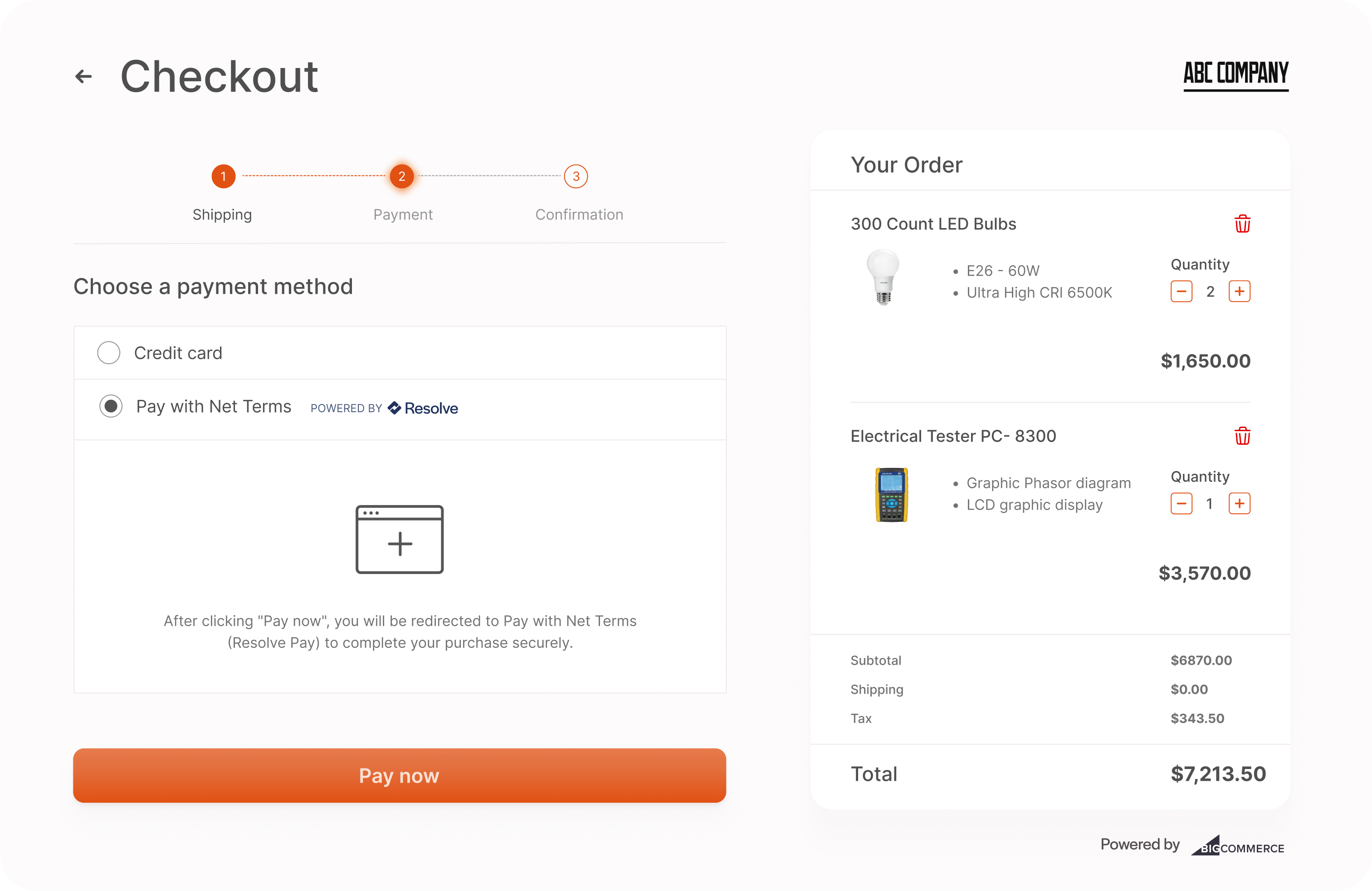

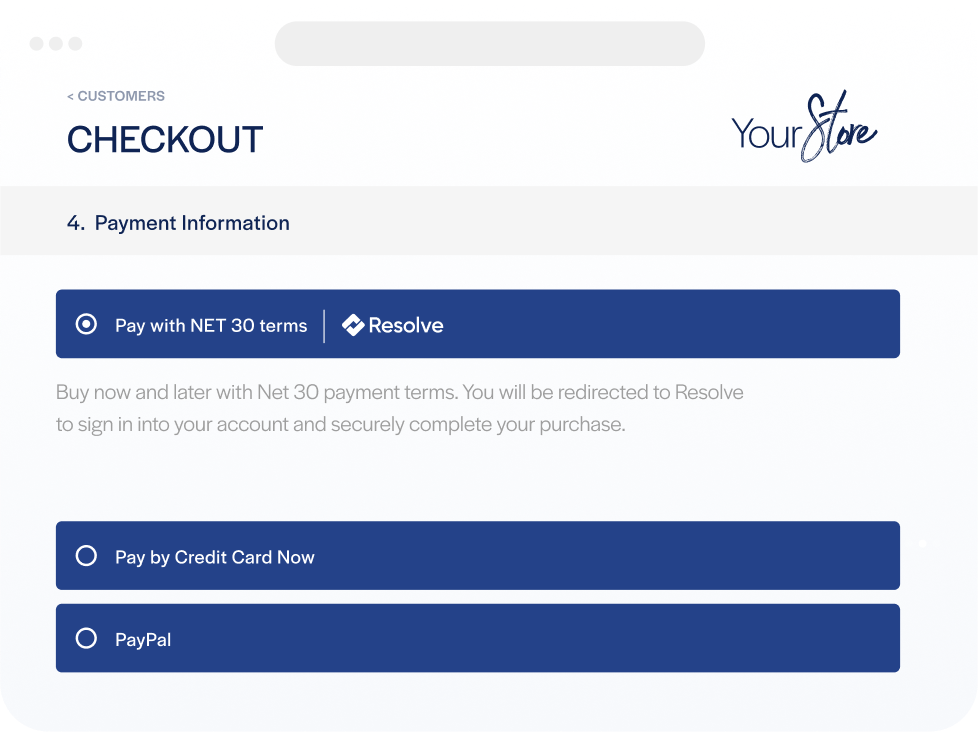

Resolve's seamless checkout extensions allows you to offer net terms and BNPL right into your checkout flow, no matter what platform you're using. Offer the net terms across all of your channels and integrate it all into your accounting stack for seamless bookkeeping.

Have custom integration needs? Resolve's flexible API can be integrated into any custom ecommerce implementation. Click here to learn more.

What does Resolve look like in your ecommerce checkout?

How do we approve your

customers for net terms?

Smart and fast

credit checks

Get paid with 100% cash up front for online B2B purchases. Also, some purchases up to $25,000 could qualify for instant approvals. Reduce DSO and increase sales with Resolve.

Offer net terms

to your customer

We'll chase payments

& manage collections

See how some of our best clients grew their businesses with online BNPL

“Resolve has had a ripple effect on my business. Improved financial velocity started improving motivation and we're therefore getting more customers. Everything's growing."

“Resolve allowed us to expand & enter new markets. We could now take larger orders on with net terms, which we previously had to turn down."