30-60

days net terms

for approved customers

100%

cash advances on

customer invoices

1

day payment to

your bank account

5%

increased margins

Managing net terms has never been this easy

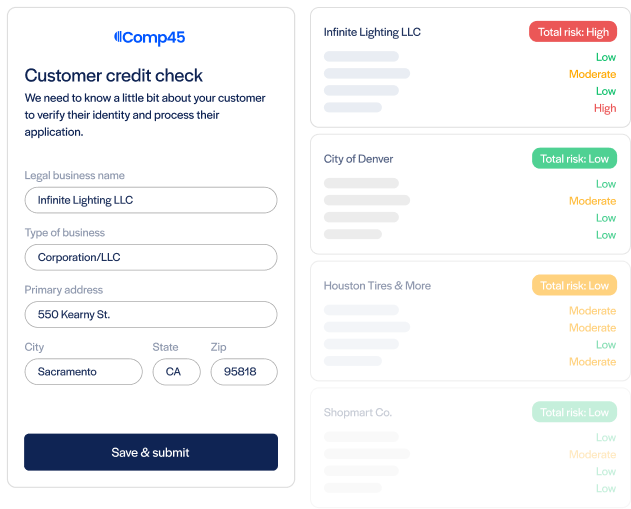

Net terms & credit management

Our complete net terms management solution takes care of everything. Easily offer net terms (30/60) to all your customers.

Accounts receivable automation

Streamline all AR processes: credit checks, reminders, collections, and payment processing.

Embedded credit team

Credit checks, credit decisions, and credit line management is fast and simple with your credit team on tap.

Reduce finance risk and bad debts

Reduce your risk of floating net terms—you're not a bank, don't act like one. We manage your terms so you can manage your business.

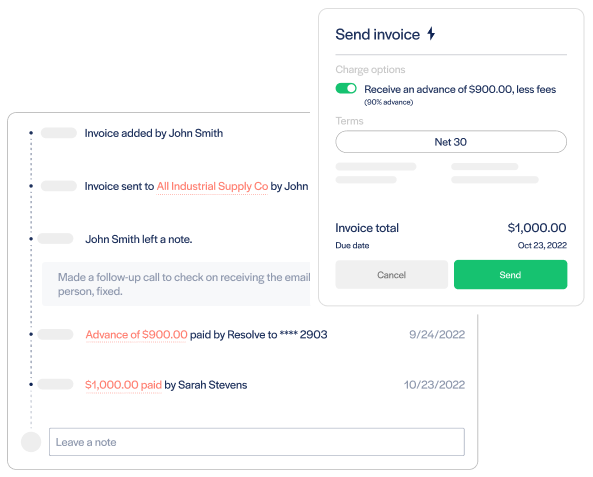

Improve working capital with cash advances

Speed up cash flow and transform the health of your business. Receive cash in the bank within days of billing. Your Net 30 will feel like Net 1 with Resolve's Advance Pay of up to 100% on invoices.

Grow your B2B sales and margins

Resolve key features

Smart Credit Engine

Our proprietary "quiet" customer credit checks are fast, reliable, and completed within hours.

Advance Pay

Receive advance cash payments on approved invoices of up to 50%, 75%, or 100%.

Payment Chaser

Take the contention out of collection. Remove the time-consuming tasks of payment reminders.

Payment Portal

Save time processing payments with our white-label Payments Portal to accepts payments by ACH, check, and credit card.

.png)