What is a cash flow statement?

A cash flow statement is a financial statement that highlights changes in assets, equity, and liability, charting the total change in use of cash during a given period. This reveals a business’ liquidity and helps analyze a company’s operating activities.

Also known as a statement of cash flows, this is one of the main reports in your financial statements documenting the total amount of cash and cash equivalents your business received and used during a specified period.

Why businesses need cash flow statements

Besides acting as a bridge between the balance sheet and the income statement, there are at least five reasons why businesses need a cash flow statement:

1. It provides proof your business is on stable financial ground

A cash flow statement lets you prove to investors that your company has squeaky-clean financials. This helps you to gain more trust and build credibility with those buying into your business, and it helps you secure more funding so you can scale.

How do you prove your business’ liquidity? That’s where a CFS comes in handy. They show the exact position of your company’s cash flow.

2. It spotlights details on changes to assets, liabilities, and equity

A cash flow statement lets you and your investors deep dive into changes in assets, liabilities, and equity. This includes cash balance, cash inflows, and cash outflows. These three areas form the accounting equation, helping you measure business performance.

3. It makes it easy to compare your financial performance with competitors

A cash flow statement makes it easier for investors to compare your business’s performance to others. For instance, one firm might be using accrual basis accounting while another uses cash basis; CFS provides a level field that eliminates the effects of these different bookkeeping techniques.

4. It helps you forecast cash flow

A CFS can help you predict future cash flows as you can create cash flow projections. You can do this by planning how much liquidity you expect in the future, which vital for long-term business planning.

5. It helps you secure more funding

The only way you can secure a loan or line of credit is by keeping your CFS up-to-date. Like investors, banks also want to see that you have positive cash flow.

Positive cash flow vs. negative cash flow

When your CFS has a negative number, that means you lost money during that accounting period (for example, you spent more cash than you received). However, just because you have a negative number does not mean you need to panic.

A negative cash flow balance doesn’t always spell doom and gloom. Sometimes you might decide to spend more cash than usual in the hope of future returns, such as investing in office equipment.

For instance, Netflix racked up negative cash flows for years as it increased spending to come up with compelling content against its competitors, with the gamble paying off handsomely.

Generally, positive cash flow indicates you have a healthy business. In the long run, it isn’t always a cause for popping champagne. While it may mean the business is currently liquid, a positive cash flow may have been a result of taking out a loan to keep the business afloat.

Where do cash flow statements come from?

If you're starting out, you can do simple bookkeeping in Excel and use your income statement and balance sheet to help you calculate the CFS.

As your business grows, you can upgrade to more robust accounting practices by using the information entered in the general ledger to automate the CFS-making process using accounting software.

How to calculate cash flow

There are two main methods of generally accepted accounting principles (GAAP) that can help you develop a CFS:

1. Direct method

The direct method refers to cash-basis accounting as you record every transaction whenever you receive or disburse cash, only bringing it up when preparing the CFS at the end of the month.

As you can tell, it takes more effort since you need to track every cash transaction, and then subtract cash flow from the inflow. That includes items such as cash receipts, interest received, and income tax payments.

2. Indirect method

Small businesses prefer this method to track cash received and cash payments from the business. They can record transactions whenever they accrue, rather than when cash changes hands, a method known as accrual accounting.

Incidentally, that means you’d have to go back to the income statement to eliminate transactions that do not reflect cash transfers. It may seem tedious, but the upshot is you don’t have to go back to reconcile your statements.

What's in a cash flow statement?

A CFS is different from the other financial statements, and there are three main sections to be aware of:

-

Cash flow from operations: This contains data on incoming cash from current assets and current liabilities, including all operational business activities such as salaries, and buying and selling inventory.

-

Cash flow from investing activities: This shows your investment losses and gains. An analyst can use this to work out the capital expenditure (CapEx) changes. For example, it includes transactions like mergers and acquisitions, or purchasing equipment.

-

Cash provided by financing activities: This is cash spent or earned through financing with loans, owner’s equity, or lines of credit. Briefly, it reveals the cash flow between you, your business, and creditors from raising money from debt, stock, or debt amortization. After you’re done with all the calculations, you will be left with a single metric: net cash flow.

The CFS may also include non-cash items such as obsolescence and depreciation expenses. Depreciation and amortization reduce net income in the income statement, although you add them back to the CFS as they are non-cash expenses.

Sidebar: Accounts receivable and account payable are nuanced in nature

It’s tempting to label cash flow as ‘cash in’ or ‘cash out,’ but the way a business spends and receives its cash is more nuanced than that, necessitating the preparation of accounts receivable and accounts payable.

The effect of accounts payable on cash flow

When a company purchases supplies, it may not necessarily pay straight away. They may get an allowance of 30, 60, 90, or 120 days before the supplier requires a payment. The purchaser records this short-term liability as accounts payable on the balance sheet.

For the purchaser, that is akin to a source of cash as it increases cash flow and cash in hand.

Although providing longer payment options can harm your cash flow, what if we told you there is a solution that allows you to do that without harming cash flow?

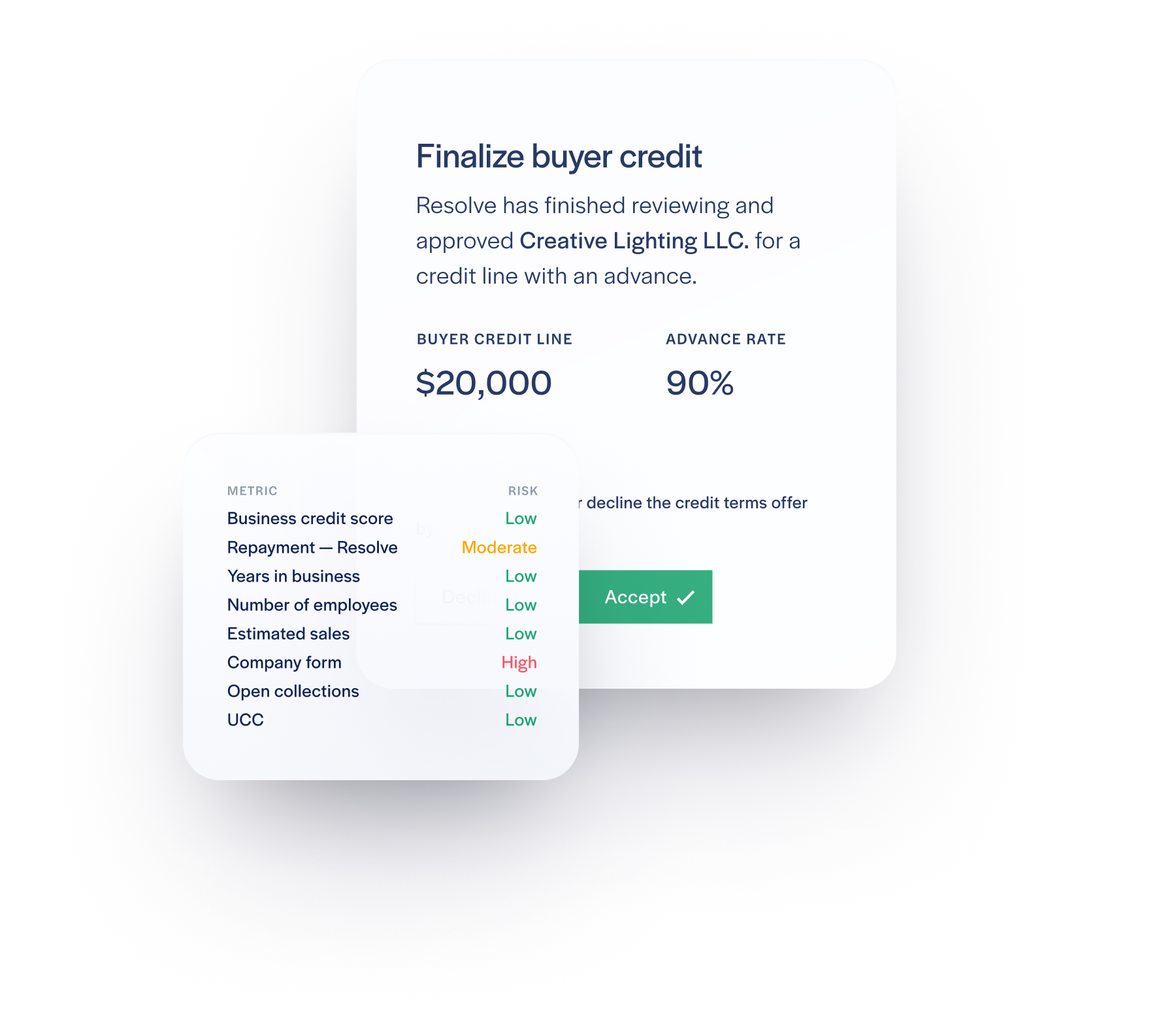

Introducing the Resolve net terms management solution. We understand you want to entice valuable customers by providing relaxed payment terms for bulk purchases. Still, you can’t always do this because it is such a hassle trying to check a customer’s credit history and credit report.

Further, you may be hesitant to offer such terms to everyone, especially given that, according to a PwC Global Economic Crime and Fraud Survey, companies lost a combined $42 billion to fraud. in 2020 alone.

At Resolve, we do the heavy lifting by taking care of:

- Credit checking

- Invoicing

- Payment processing

- Payment reminders

- Credit line approvals

- AR collections

More importantly, when it comes to cash, we also offer advance cash payments on approved net term invoices. What's more, integrated receivables solutions like Resolve are becoming more and more popular.

Accounts receivable and the cash flow statement

On the other hand, accounts receivables refer to cash due to your business for services or goods delivered but not paid. Put differently, these are the outstanding invoices unpaid by customers.

It's a short-term line of credit extended to regular customers with an obligation to pay within a set date, often 30, 60, 90, or 120 days.

The effect of account receivables on cash flow

Account receivables are cash to your business and a short-term liability to the customer. Your cash flow considerations will determine how long you can allow a customer to go without paying.

On the balance sheet, the supplier records the short-term credit as current assets, affecting cash flow as accounts payable. Allowing a customer more time before they pay is an account receivable.

For instance, if you make a sale of $10,000 with terms of sale at 50% cash and 50% credit payable within 60 days, record the $5,000 as sales since it is a cash inflow. You will record the balance as an inflow when it is paid.

Here, Resolve can come in handy to enhance your accounts receivable. Did you know that Resolve makes net terms risk-free? We shoulder all the risk as we are the lender.

What’s more, we offer up to 90% of customer’s invoices, processed within one day. After analyzing a client, we advise you to grant them 30, 60, or 90 days within which to pay us. That way, your business will always have cash flow, whatever your accounts receivable situation.

How to record accounts receivable

In the double-entry system of bookkeeping, if you make credit sales, debit accounts receivable—meanwhile, credit cash sales as income.

If you use the accrual concept, that means accounts receivable will increase along with sales, that is to say, they form part of your net profit.

The CFS’s starting point is net profit, which increases although there are no cash transactions. This is unacceptable. Therefore, deduct any net profit or indirect sales that do not involve such transactions.

You have to deduct increases in accounts receivables from the net profit to cash used from operations.

The financial statement presentation of accounts receivable

Remember to subtract any increases in accounts receivables from net profit and add any decreases in accounts receivables back to net profit.

When you debit the cash or bank account against accounts receivable, only the accounts receivable entry impacts cash flow. Therefore, make sure to record this movement in your cash flow statement.

First, subtract the current period cash amount in your accounts receivable from the previous period’s cash amount. A positive result indicates an increase in accounts receivable, which uses cash and reflects a cash flow decrease by the same amount.

Conversely, a negative result points to a cash flow increase of the same magnitude.

Ready to break the shackles of risky net terms while improving your cash flow and accounts receivables? Why not try Resolve net terms financing for B2B businesses? We even offer free business credit check as part of the free trial offer. Get a demo today.