2x

increase in buyer

purchasing power

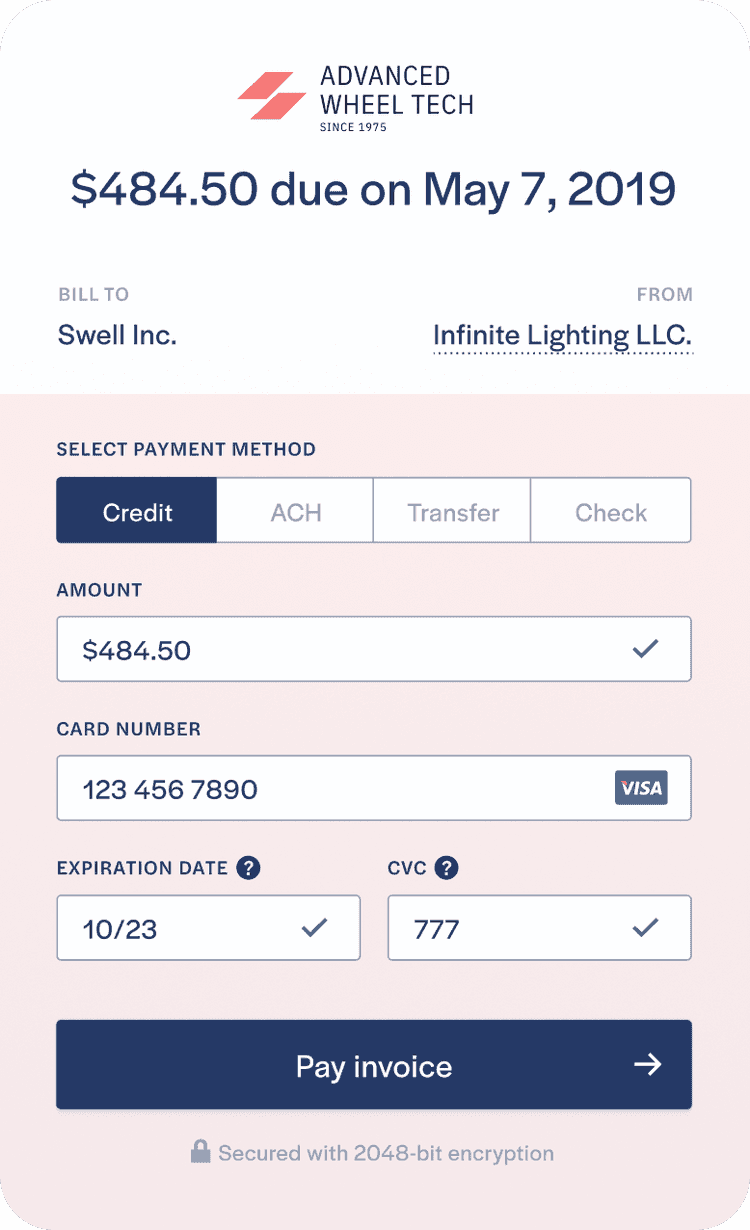

30-60%

days faster

payment

50%

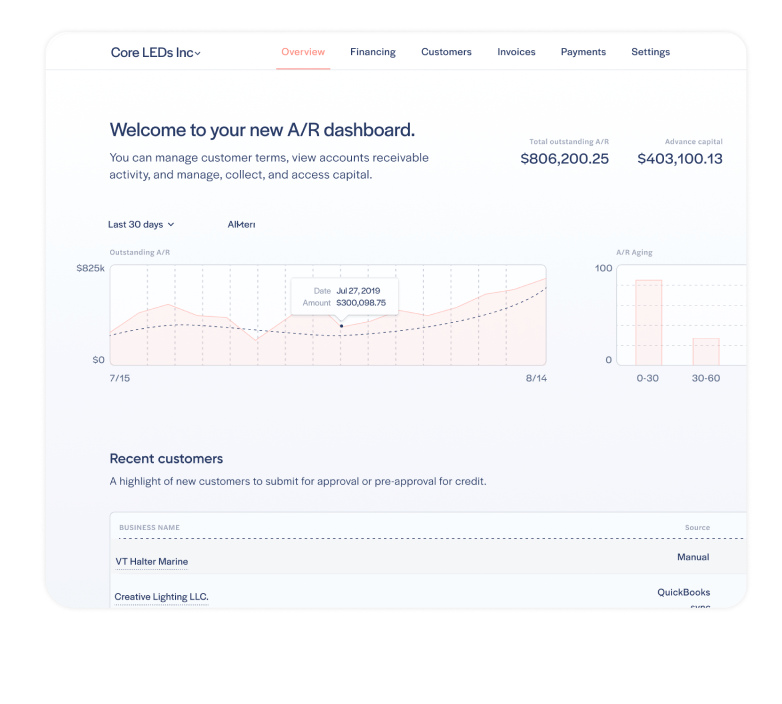

less time managing

receivables

9x

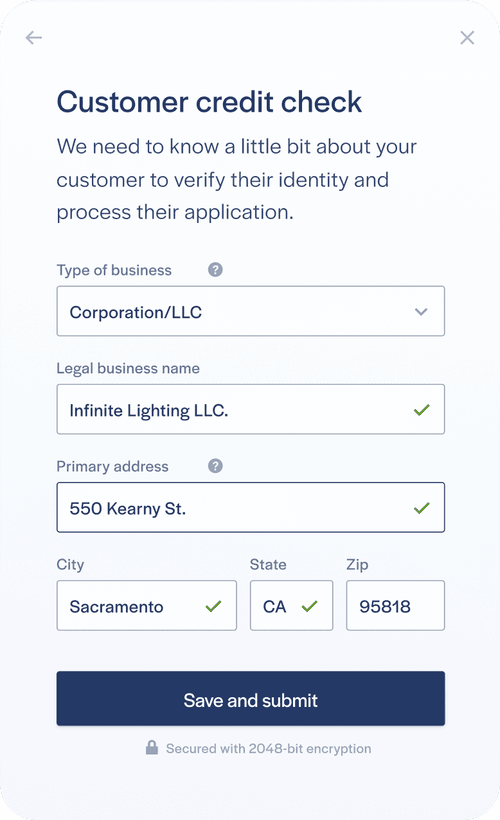

faster

credit checks

How does Resolve work?

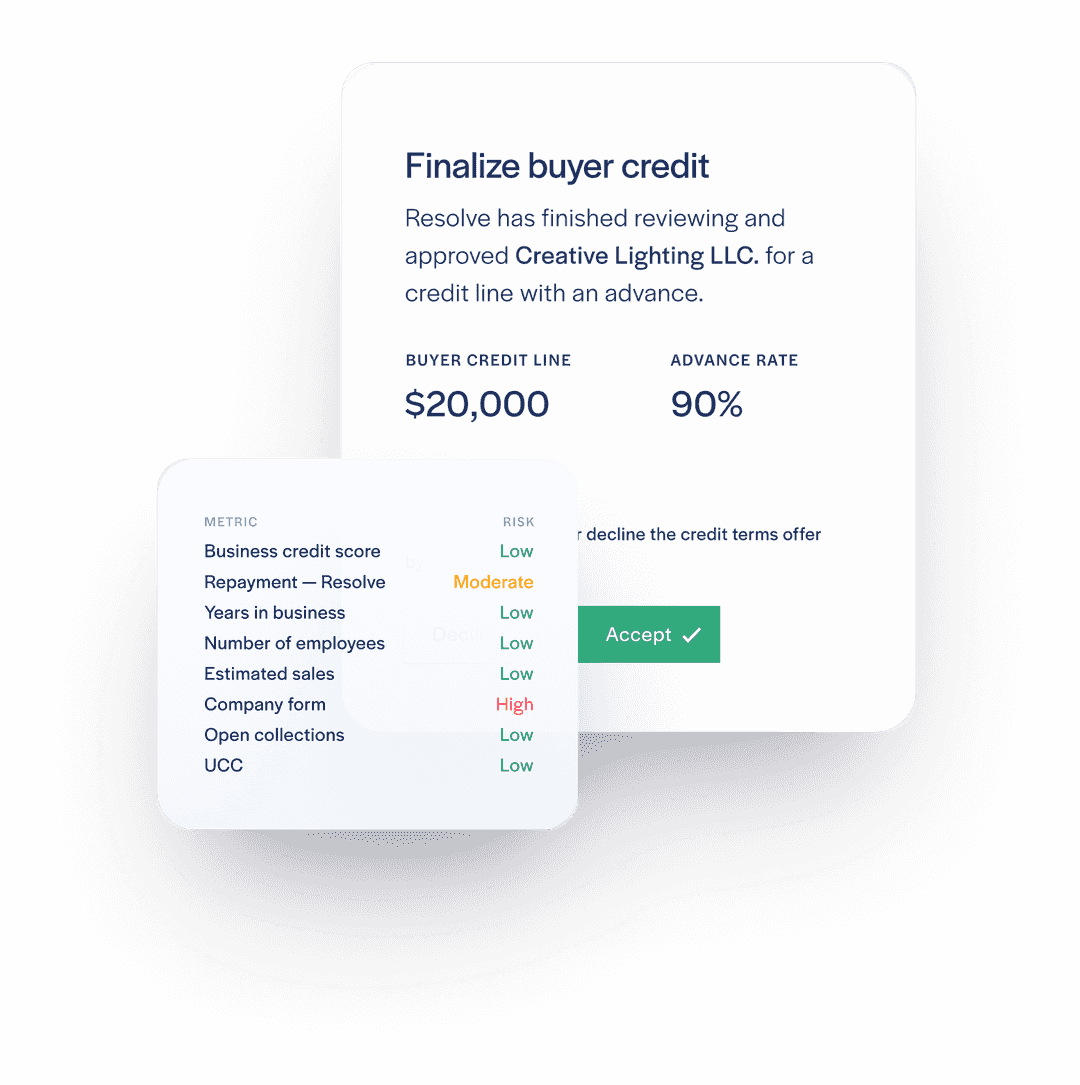

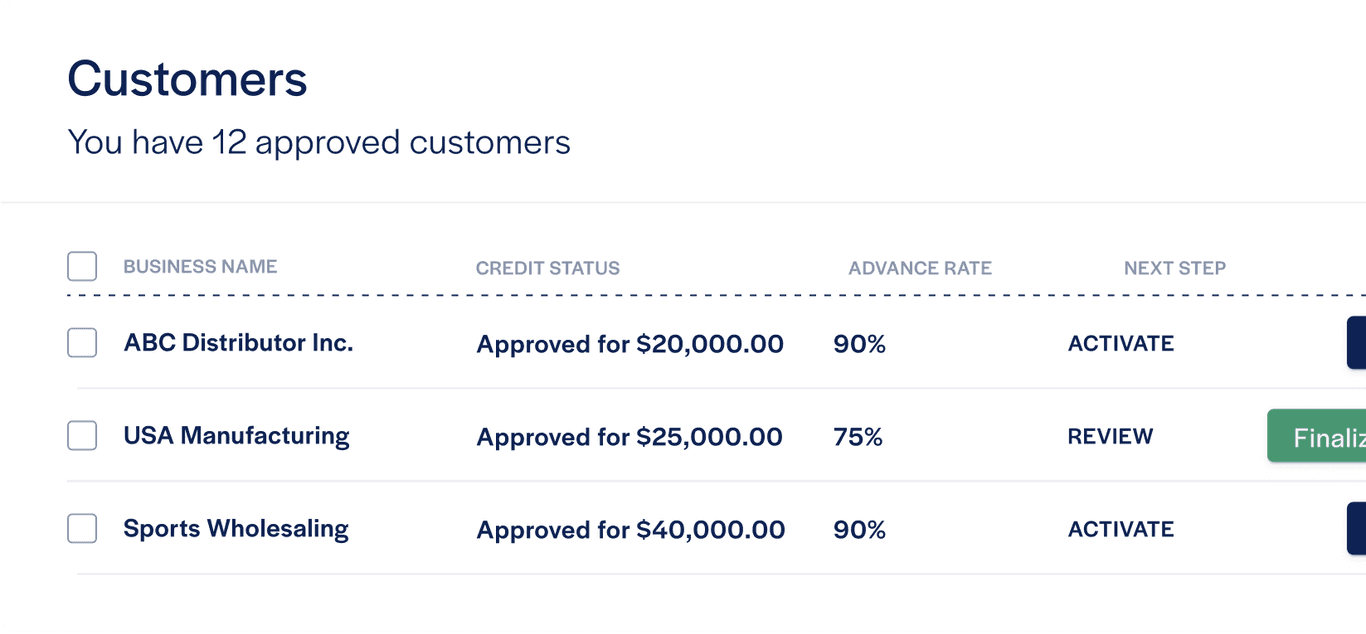

Resolve runs smart credit checks

Approved customers qualify for Advance Pay. This means up to 100% paid upfront on invoices.

Offer risk-free net terms

Resolve is non-recourse and risk-free to you.

We'll chase payments & collections

Resolve is like your 'credit team' on tap. We process payments, send reminders, and collect as needed.

One-Pager: Resolve vs. Factoring, Lines of Credit & Trade Credit Insurance

A straightforward comparison of legacy options vs. Resolve’s modern credit-to-cash platform. Learn why factoring can strain relationships, LOCs keep you in debt, and TCI moves slow—plus how Resolve pays you upfront while your buyers keep terms.

“Resolve has had a ripple effect on my business. Improved financial velocity started improving motivation and we're therefore getting more customers. Everything's growing."

“Resolve allowed us to expand & enter new markets. We could now take larger orders on with net terms, which we previously had to turn down."