Unified platform: Net Terms, Growth, and Risk Management.

Resolve integrates payments, credit, and liquidity into a single infrastructure designed specifically for B2B commerce.

Sale growth across every B2B channel

Deliver a consistent, high-conversion experience whether your customers transact online, offline, through field reps, or via embedded checkout.

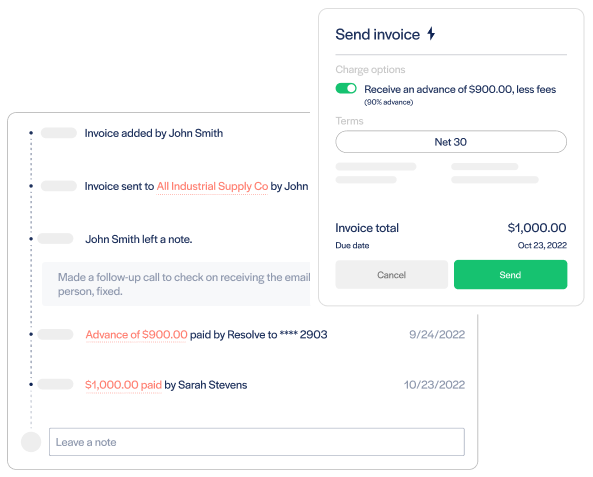

Accelerated liquidity, without risk

Resolve underwrites your customers in real time and advances up to 90% of your invoice value—within 24 hours.

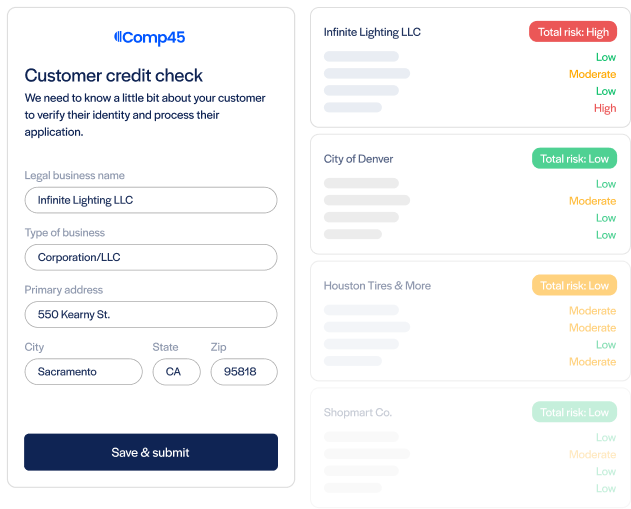

Adaptive underwriting, built for B2B

Our proprietary AI models evaluate thousands of buyer data points, from cash flow trends to behavioral signals, to generate dynamic, scalable credit decisions.

Flexible terms to deepen buyer loyalty

Offer extended net terms or installment options tailored to each customer—without delaying your cash flow.

Trusted by over 12,000+ B2B businesses

Grow your B2B sales and margins

Improve working capital with cash advances

Speed up cash flow and transform the health of your business. Receive cash in the bank within days of billing. Your Net 30 will feel like Net 1 with Resolve's Advance Pay of up to 100% on invoices.

Reduce finance risk and bad debts

Reduce your risk of floating net terms—you're not a bank, don't act like one. We manage your terms so you can manage your business.

AI-enhanced financial solutions

reduce risk and accelerate growth

B2B Payment Portal

Improve your customer's experience by giving them more ways to pay with a professional, company-branded, billing experience.

AR & Credit Dashboard

Understand and reduce risk by proactively managing AR and maximize your customer's credit lines.

QuickBooks Auto-Bookkeeping

Save time on manual reconciliations. Resolve automatically records and syncs all transactions to QuickBooks.

Advance Pay

Don't lose the sale. Access fast and reliable financial assessments of your customer's credit within hours.

Smart Credit Engine

A white-label payment portal that gives your customers more ways to pay.

Ecommerce Checkout Extension

Give online customers the option to apply for net terms at checkout. Approvals are granted within hours.

Best B2B Payment Platforms for Material Handling Equipment Companies

Discover the best B2B payment platforms for material handling equipment companies to streamline financial operations and maintain healthy c...

Best B2B Payment Platforms for Compressed Air Systems Companies

Explore top B2B payment platforms tailored for compressed air systems companies to manage high-value transactions, extended payment terms, ...

Subscribe to our newsletter

Get the best stories, insights, and AR best practices delivered to your inbox every month.

.png)