Built for Operational Scale, Not Just Speed

Resolve is more than credit checks—we’re the infrastructure behind safe, scalable B2B commerce (online and offline).

Our platform combines AI, behavioral signals, and human expertise to eliminate friction across the credit lifecycle.

Sell across every B2B channel

Seamlessly extend B2B terms online, offline, or through sales reps with embedded net terms at every touchpoint.

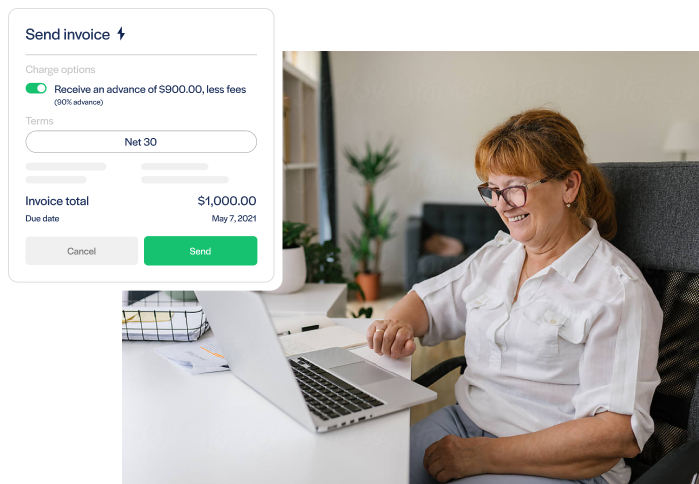

Get paid upfront, without the risk

Resolve advances payment on approved invoices, so you can fund operations without waiting

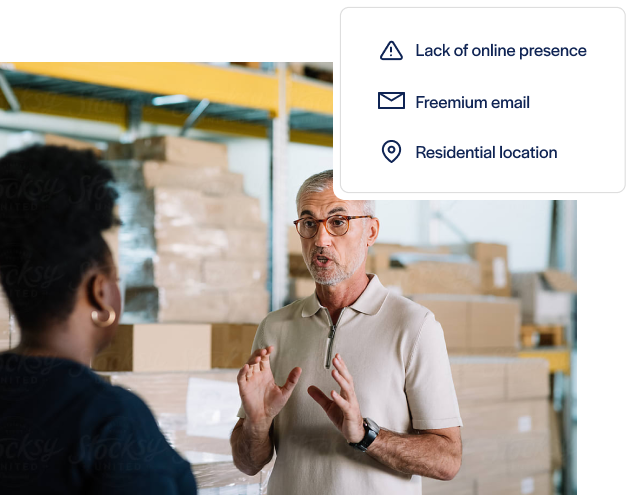

Adaptive underwriting

Proprietary AI models evaluate buyers in real-time, tailored to your business, not a one-size-fits-all rulebook.

Flexible terms that grow loyalty

Offer net 30, 60, or 90 day options while Resolve handles the risk, collections, and receivables.

De-risk your customer credit decisions

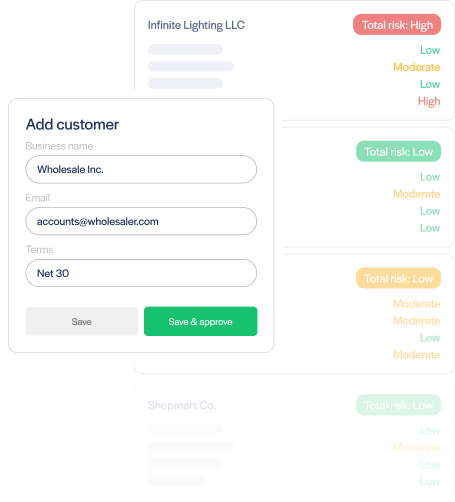

Fast Credit Approvals, No Forms Required

Creditworthiness You Can Trust

Take Control of Credit Risk

The features that set Resolve apart

B2B Payment Portal

Improve your customer's experience by giving them more ways to pay with a professional, company-branded, billing experience.

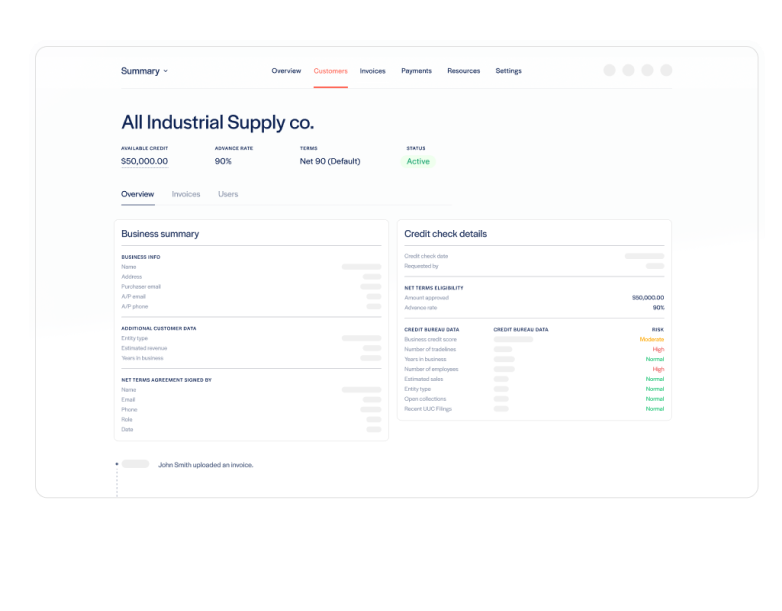

AR & Credit Dashboard

Understand and reduce risk by proactively managing AR and maximize your customer's credit lines.

QuickBooks Auto-Bookkeeping

Save time on manual reconciliations. Resolve automatically records and syncs all transactions to QuickBooks.

Advance Pay

Don't lose the sale. Access fast and reliable financial assessments of your customer's credit within hours.

Smart Credit Engine

A white-label payment portal that gives your customers more ways to pay.

Ecommerce Checkout Extension

Give online customers the option to apply for net terms at checkout. Approvals are granted within hours.

Best B2B Payment Platforms for Material Handling Equipment Companies

Discover the best B2B payment platforms for material handling equipment companies to streamline financial operations and maintain healthy c...

Best B2B Payment Platforms for Compressed Air Systems Companies

Explore top B2B payment platforms tailored for compressed air systems companies to manage high-value transactions, extended payment terms, ...

Frequently asked questions

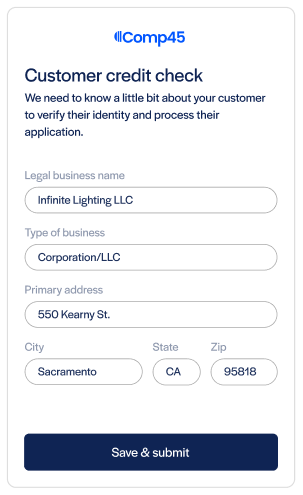

How does Resolve Pay's business credit check process work?

Resolve offers a streamlined credit assessment by requiring only your customer's business name and address, delivering results within 24 business hours.

Is there a cost associated with using Resolve Pay's credit check service?

Resolve provides personalized business credit checks free of charge, assisting you in making informed credit decisions.

What makes Resolve Pay's credit assessments reliable?

Resolve's assessments are conducted by experts with experience from companies like Amazon and PayPal, ensuring high-quality and personalized credit evaluations.