B2B Payments Built for Scale

Accelerate Cash Flow with Advance Pay

Receive up to 90% upfront on approved invoices. Our ML-driven credit engine evaluates buyers in real-time. You get faster liquidity, without the wait.

Extend B2B Payment Terms, Without Risk

Let customers pay on 30, 60, or custom terms while Resolve pays you immediately. Our proprietary AI underwrites and insures every invoice, so you can scale sales confidently.

Offer Seamless, Flexible Payment Options

Your customers enjoy a branded portal offering ACH, credit card, wire, or check. Our LLM-powered invoicing workflow ensures every transaction is synced and reconciled automatically.

We improve B2B payments for 15,000+ businesses

Net terms for B2B buyers. Immediate cash for you.

QuickBooks Online + AI-Powered bookkeeping

- Cut reconciliation time

- Gain end-to-end payment traceability

- Keep financials accurate with zero lift

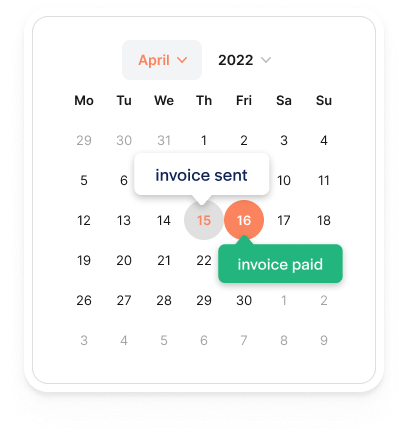

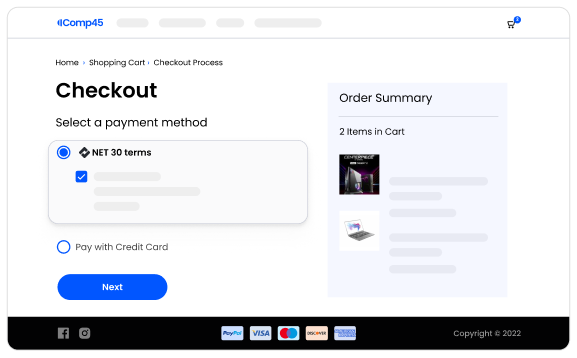

Net terms at ecommerce checkout

The features that set Resolve apart

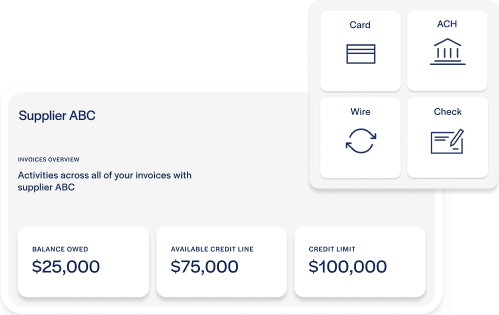

B2B Payment Portal

Improve your customer's experience by giving them more ways to pay with a professional, company-branded, billing experience.

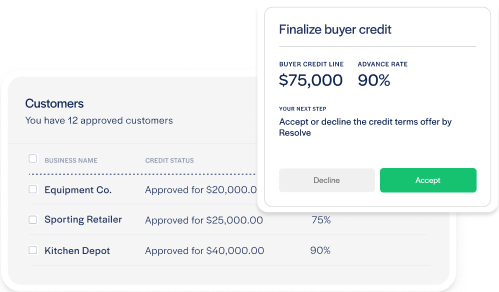

AR & Credit Dashboard

Understand and reduce risk by proactively managing AR and maximize your customer's credit lines.

QuickBooks Auto-Bookkeeping

Save time on manual reconciliations. Resolve automatically records and syncs all transactions to QuickBooks.

Advance Pay

Don't lose the sale. Access fast and reliable financial assessments of your customer's credit within hours.

Smart Credit Engine

A white-label payment portal that gives your customers more ways to pay.

Ecommerce Checkout Extension

Give online customers the option to apply for net terms at checkout. Approvals are granted within hours.

Resolve streamlines B2B payments on both sides

For your customers

Company-branded payment portal

Offer your own branded and professional payments & billing experience to improve your customer's experience.

- Secure online login and access

- One dashboard to view all invoices, credit lines, and history.

- Easy online payment options: ACH, transfer, or credit card.

For your business

Accounts receivables dashboard

Strategically unlock cash flow and make smarter business decisions. Utilize larger credit lines, export payment summaries, manage credit & AR processes.

- Easily view all outstanding AR.

- Access credit line summaries & advance rates for all customers.

- Export and sync payment history.

Best B2B Payment Platforms for Material Handling Equipment Companies

Discover the best B2B payment platforms for material handling equipment companies to streamline financial operations and maintain healthy c...

Best B2B Payment Platforms for Compressed Air Systems Companies

Explore top B2B payment platforms tailored for compressed air systems companies to manage high-value transactions, extended payment terms, ...

.png)