Scale your credit & AR processes with your growth

Workflows designed for your business and your buyers. Bring our embedded net terms resources to your financial tech stack.

What you get by working with Resolve

Fast credit checking

Net terms invoicing and workflows

Automated AR workflow (invoice reminders)

Buyer payment portal (ACH, wire, credit card, check)

Credit line recommendations

Invoice advance payments

Payment chaser workflows (fees, collections)

Standard invoicing workflow

Credit and AR insights dashboard

ACH and wire transfers all included

- Max. buyer credit line sizes are not guaranteed, all decisions are at discretion of Resolve and subject to buyer verification.

- Credit card fees are passed on to your buyer (via online payment portal)

- Invoice advance payment rate/percentages: Typically 90%, 75%, 50%

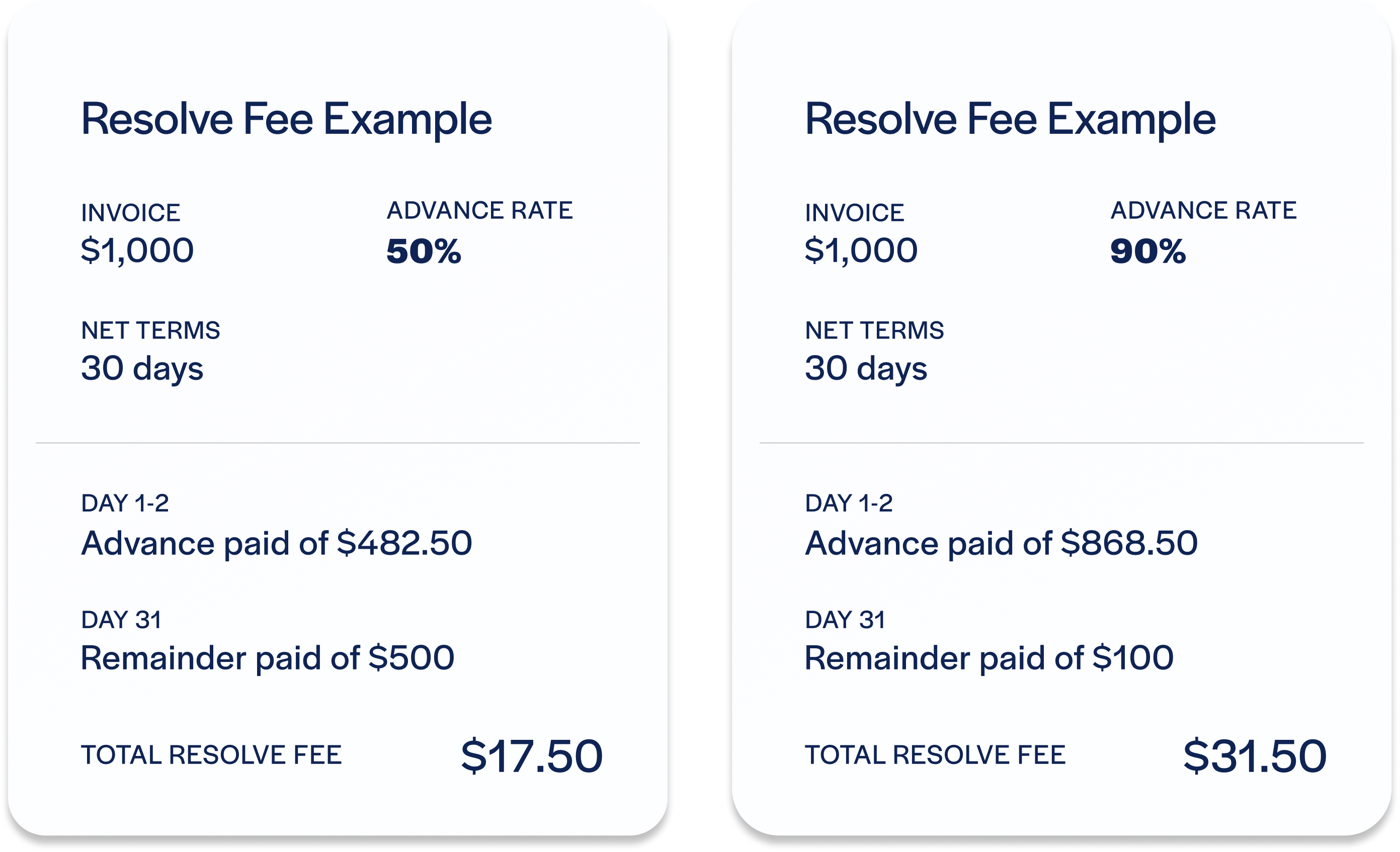

What do Resolve's fees look like for a $1,000 invoice?

Resolve’s Advance Pay gives you flexibility in de-risking net terms invoicing. This example shows you can choose 50% vs. 90% advances to suit your needs.How does an invoice with a 90% advance get paid?

Resolve Timeline: $1,000 Invoice - 90% Advance Rate - 30 Day Net Terms