2x

increase in buyer

purchasing power

30-60%

days faster

payment

50%

less time managing

receivables

9x

faster

credit checks

Getting started with Resolve is easy

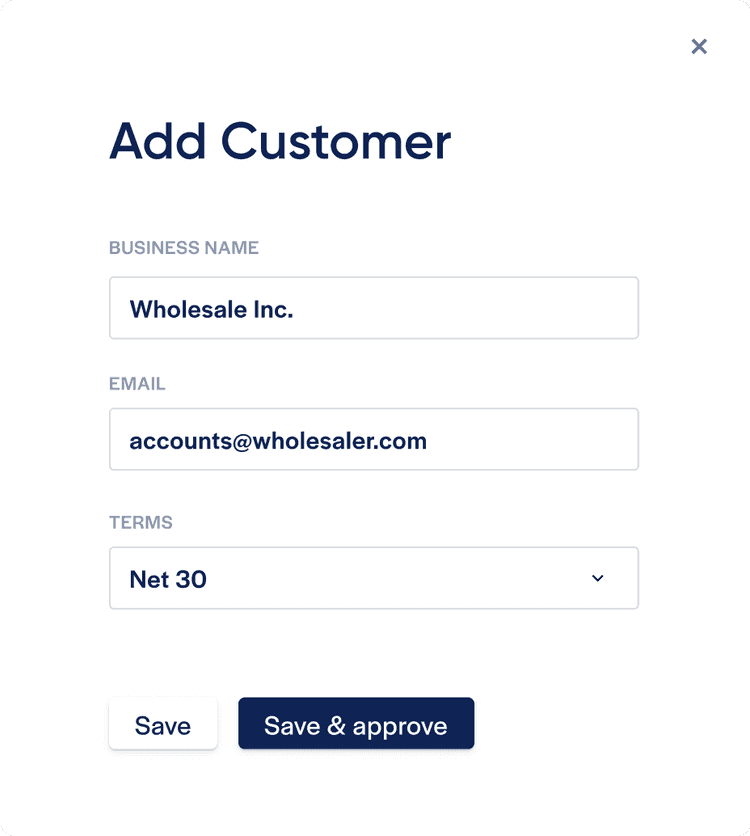

Sync your customer details

Resolve' syncs with QuickBooks Online to help you seamlessly select which ones to run through our simple and fast credit assessment.

We help update the payment details

Resolve helps you reach our to your existing customers with updated payment details. You're in control, choose automated or manual emails.

Your customers get more ways to paid

Resolve's payments portal accepts payments by ACH, check, and credit card. We give your customers more flexibility and options.

Resolve stays in the background

Our team is here to help with every step

Resolve offers world-class customer service and support. You won't be on your own - we'll help with accounting system connections, net terms migration, and product training.

Resolve key features

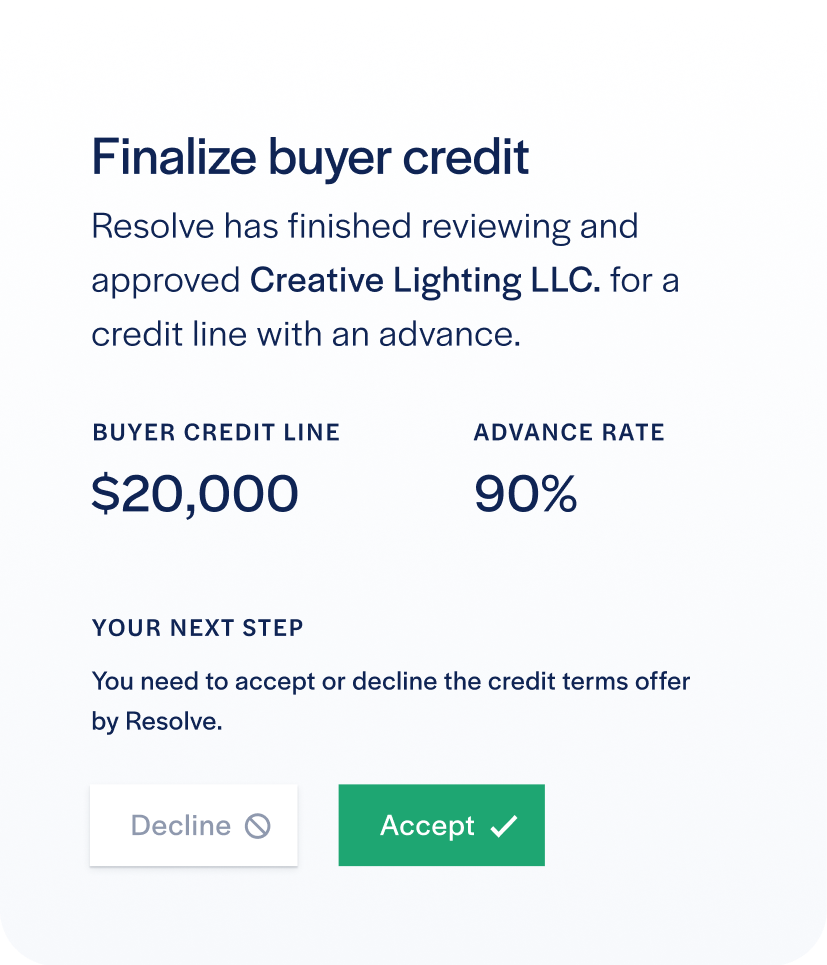

Smart credit engine

Resolve's credit check of your customer is completed within hours. Our Smart Credit Engine means fast and simple financial assessment of your customer for net terms and a credit line.

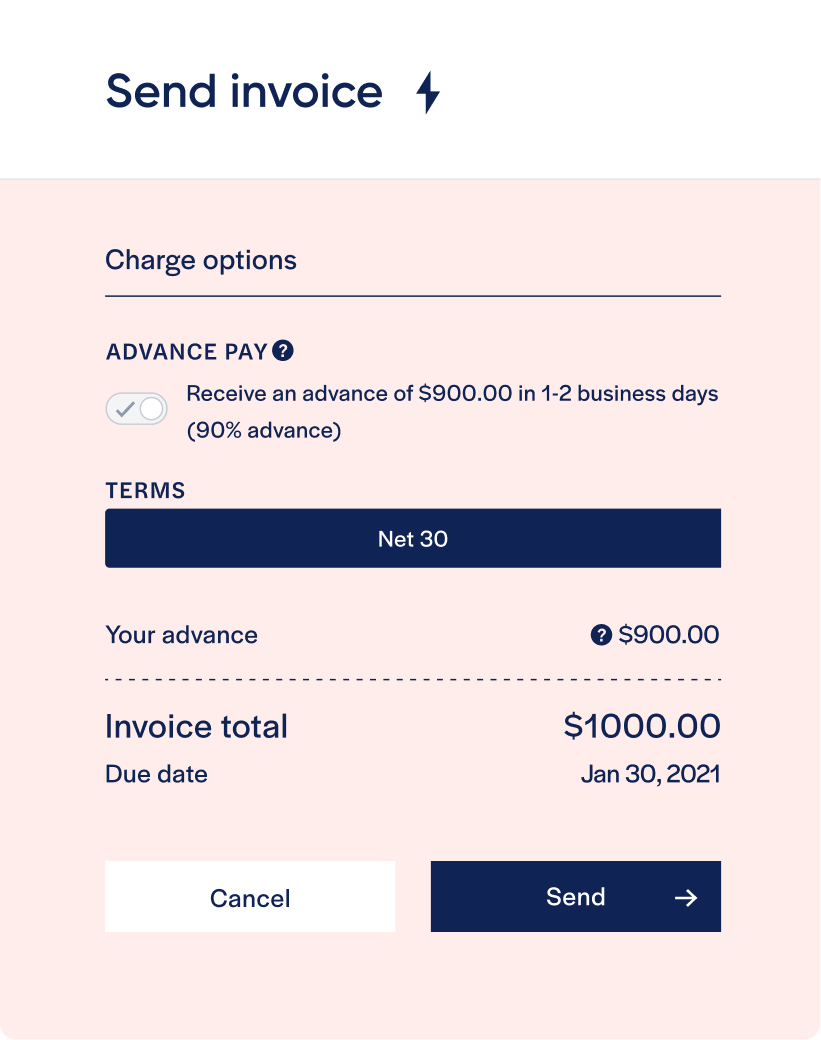

Advance Pay

Resolve's Advance means your invoices get paid upfront. Once approved, your customer's risk profile will be for 50%, 75%, or 90% advance rates (meaning we'll pay out 100% of the invoice).

Payment Chaser

Resolve's Payment Chaser product enhances your 'credit team' resources, we automate the time-consuming tasks of payment reminders, servicing, and collections.

Payment Portal

Resolve's Payment Portal accepts payments by ACH, Check, and credit card. We take care of processing your customer payments, saving your team time.

“Resolve has had a ripple effect on my business. Improved financial velocity started improving motivation and we're therefore getting more customers. Everything's growing."

“Resolve allowed us to expand & enter new markets. We could now take larger orders on with net terms, which we previously had to turn down."

.png)