For many B2B businesses, purchase orders (POs) are a crucial element of their operations. Whether you're a buyer or a vendor, a well-managed PO process can be the difference between meeting your quarterly or annual goals. Streamlining the PO process is essential for improving efficiency and fostering a more seamless, positive experience for both parties involved.

Below is a straightforward model outlining the typical flow of a PO from buyer to vendor and back to buyer. Understanding this basic flow is vital when designing your own PO process, ensuring that all steps are captured for clarity and efficiency.

In addition to improving operational flow, leveraging technology can further enhance your PO process. Tools like automated purchase order systems can not only reduce human error but also accelerate the approval and payment cycles. By integrating these tools into your workflow, you can improve visibility into your purchasing decisions, gain insights into spending trends, and enhance vendor relationships, all while saving time and reducing costs.

Step 1: Buyer creates an internal purchase requisition

While many small businesses may skip this step altogether, it is still important to note as it remains vital for those in highly structured organizations. However, this process varies by company.

The employee responsible for the purchase will usually fill out documentation requesting funds from the firm’s finance or purchasing department for a particular purpose. This department then has the ability to approve or deny the purchase requisition.

Step 2: Buyer sends purchase order to vendor

In the event of an approved requisition, the PO is ready to be created and sent out! Smaller companies will usually begin the PO process here.

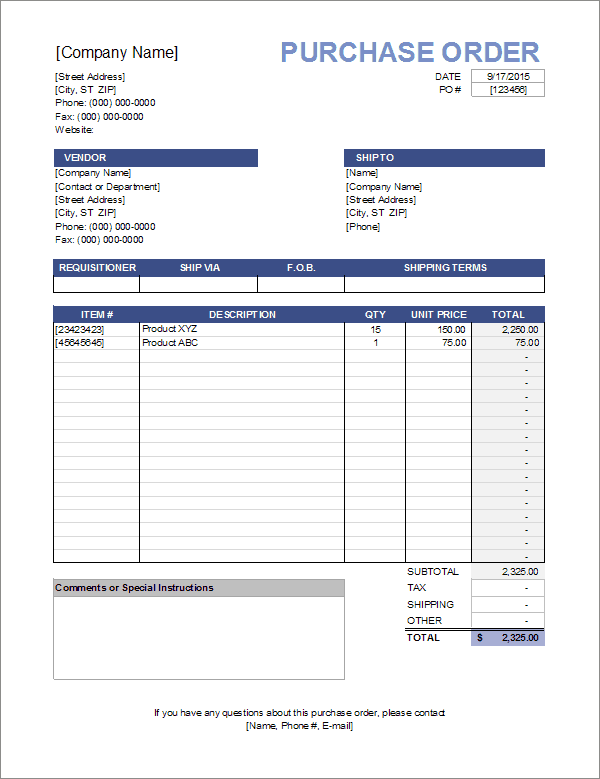

The average PO will look a lot like any other document on official letterhead that is owned by the business. It will include pertinent company information, such as:

- Mailing address

- Email address

- Phone number

- The name of the buying firm’s primary contact

The buyer will also include necessary information about the vendor. From there, the names and quantities of the items requested are listed. Their respective prices are calculated, with taxes, fees, and shipping to come up with a total value for the PO.

Step 3: Vendor chooses to accept or deny PO

Upon receipt of the PO, the vendor will process the request and determine if it has the capacity to fill the order. The vendor may choose to reject the buyer’s PO for a variety of reasons, including:

- Inaccurate prices listed on PO

- Products/services listed on PO are unavailable

- The PO cannot be fulfilled as requested

Vendors must ensure that all requirements laid out in the PO can be met by their organization, as it is a legally binding document.

Step 4: Vendor fulfills the purchase order

Once approved, the vendor will fulfill the terms of the purchase order as agreed upon by both parties. This process will, of course, vary from PO to PO. On one end of the spectrum, a local supplier receiving a purchase order for a supply of goods will prepare and ship those items in this step.

On the other hand, a top-rated law firm receiving a PO from a client will begin working on what could become a year-long dispute. An invoice is sent to the buyer at the conclusion of the fulfilment period.

Step 5: Buyer performs a three-way match

Once the goods and/or services are provided, the buyer will match the initial purchase requisition, PO, and invoice to ensure that all elements align. These will also be matched against the actual goods delivered or service hours performed. Any discrepancies are usually handled by simply contacting the vendor and explaining the situation. Once settled, the PO can officially be closed.

Processing purchase orders is critical for all businesses

Whether small or large, nearly all businesses will send or receive a PO at some point within the existence of their organization. While somewhat confusing initially, POs provide clear and concise expectations from both parties in the engagement.

It is also important to reiterate that these are legal documents that will stand firm in the event of litigation. Be sure to reference this guide in its entirety when carrying out your business’s first PO.