You spoke, and we listened! NetSuite and Resolve are now integrated, providing you with enhanced visibility, greater control, and streamlined efficiency in your workflow—making bookkeeping smoother than ever before!

This integration allows for real-time updates, seamless data flow, and improved financial tracking, giving you the tools to make more informed decisions. With NetSuite's comprehensive financial management paired with Resolve's efficient payment solutions, you can now focus more on growing your business and less on manual processes. Additionally, this integration helps reduce errors, improves cash flow management, and ensures your financial data is always up to date.

What changes were implemented and how will that benefit my business?

- Previously, you would have to manually input all your invoice information from NetSuite into Resolve, reconcile the information once the payment was made and upload each one of your customers individually to the Resolve platform.

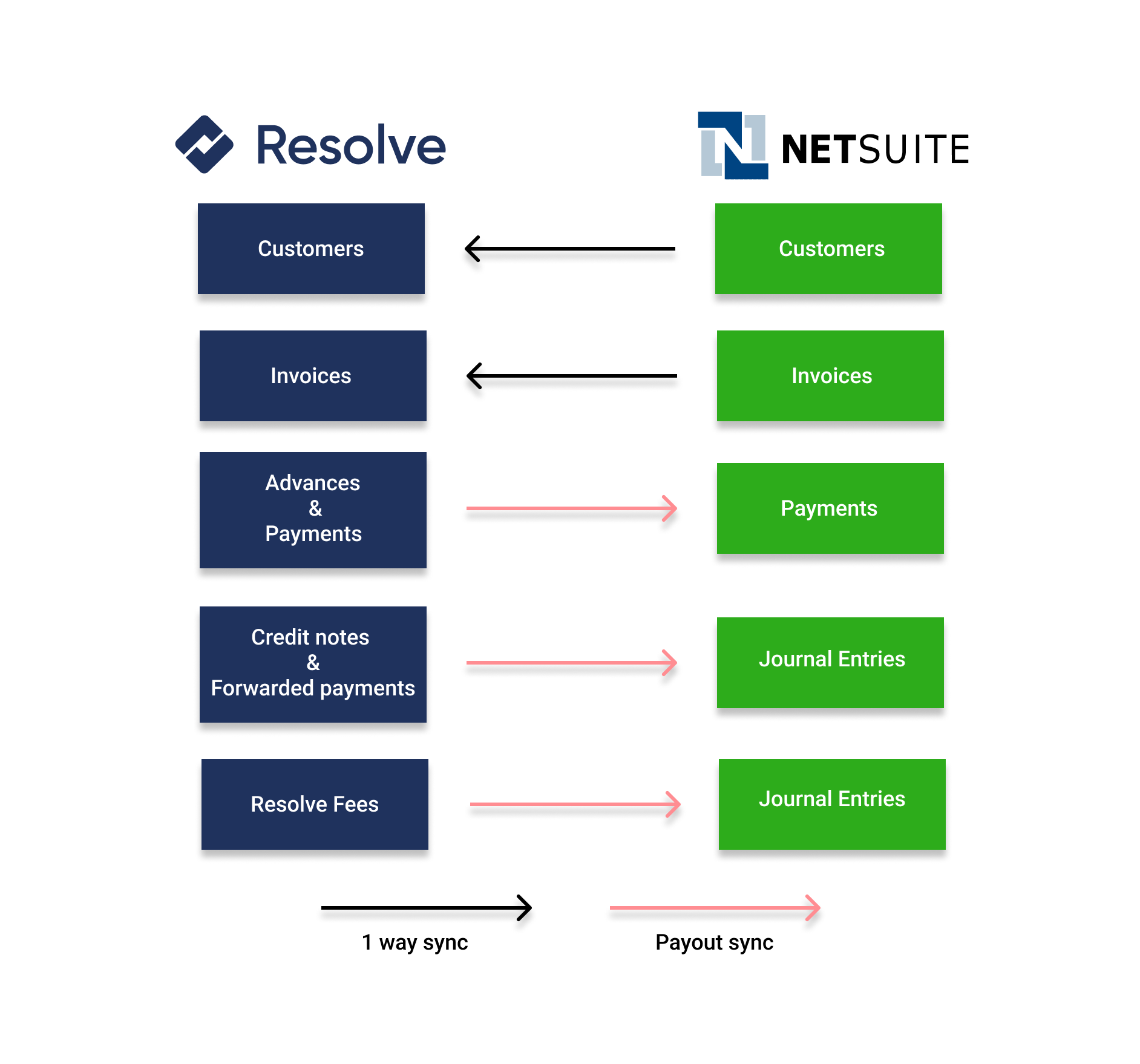

- Now, a 2-way payment sync is available - you can both pull customers and invoices from NetSuite along with pushing payout records from Resolve back into NetSuite to name a few.

Below is a summary of the record types that are synchronized with the payout sync enabled.

Simply put, this new integration saves your accounting and finance team time and reduces errors as a result of manual data entry.

Benefits of NetSuite ERP Integration with Resolve

The benefits of seamless integration with Resolve are endless but to highlight a few:

- Enhanced Visibility and Control with Streamlined Payment Syncs - gain complete control over your invoices. Select invoices to receive cash advances on in NetSuite and they will sync directly to Resolve where you can complete the process in our dashboard.

- Improved Efficiency and Productivity with Simplified Workflow Management - as you can now sync customer details directly from NetSuite to Resolve, you’ll also be able to run fast, quiet credit checks without completing a lengthy application form.

- Reduced Errors and Costs with Automated Bookkeeping - save time and headaches reconciling your books and take advantage of more traceability between invoices and payments.

NetSuite ERP Integration with Resolve - How does it work?

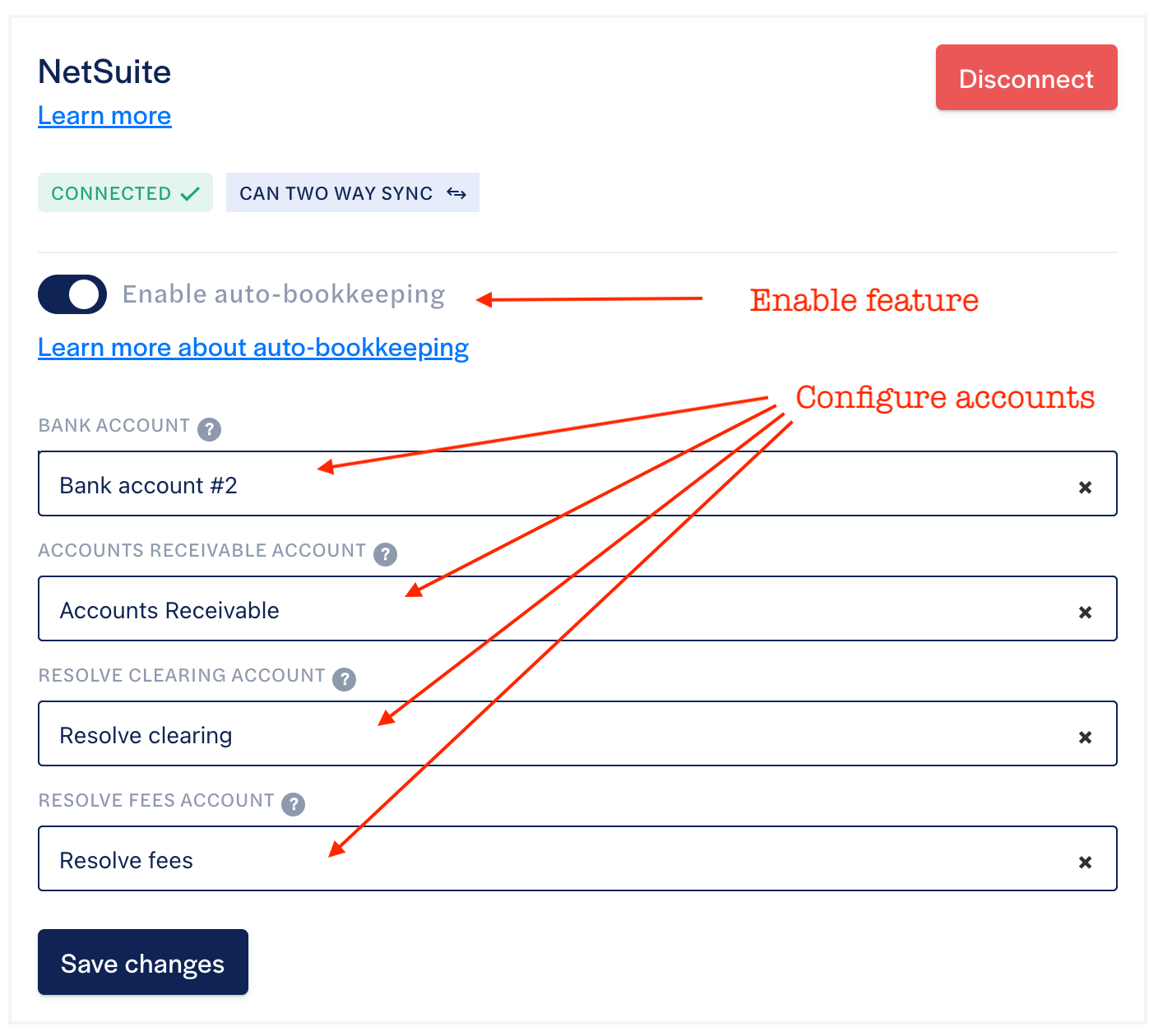

It’s quite simple to turn on your integration, once you connect your NetSuite account with Resolve you can:

-

Enable the "Auto Bookkeeping" setting

-

Specify which accounts you would like to use (from your chart of accounts)

- Bank account: This should be the same bank account that you have connected with Resolve to receive payouts.

- Resolve clearing account: We recommend creating a new account called "Resolve clearing" or something similar if you don't already have one. This needs to be an "Other Current Asset" account.

- Resolve fees account: We recommend creating a new account called "Resolve fees" or something similar if you don't already have one. This needs to be an "Expense" account.

- Once you save the configuration, Resolve will start writing these additional records to NetSuite.

Read the Auto Bookkeeping for NetSuite help article to get a full rundown of all the steps with visual guides and use cases.

Who can benefit from NetSuite ERP Integration with Resolve?

NetSuite ERP integration with Resolve offers a range of benefits, making it an ideal solution for businesses in various industries. The integration enables real-time visibility into inventory, sales, and financial data while automating manual processes to reduce errors and improve efficiency. As a result, companies can enhance customer service by providing faster response times and accurate information. Additionally, small and medium businesses, as well as accountants and finance professionals, can benefit significantly from the streamlined workflows that the integration provides.

Small and medium businesses

The integration streamlines business processes, improves efficiency, and increases productivity. Resolve offers a range of automation tools that can help businesses save time and money. The integration can also help businesses manage their inventory, sales orders, and customer data more effectively. Overall, the integration can help small and medium businesses grow and succeed in today's competitive marketplace.

Accountants and finance professionals

With real-time updates and visibility into financial data, AR teams can make more informed decisions. The integration reduces the risk of errors and increases efficiency in financial operations. Resolve can also help with invoice processing and accounts payable/receivable management, saving time and resources. Overall, the integration can improve accuracy while enhancing productivity in financial processes.

Next steps, connect NetSuite to Resolve

If you are an existing customer with Resolve, get in touch with your designated customer service manager to learn more about the integration and if you’re considering Resolve download our NetSuite one-pager or please speak to our payment specialists to learn more about Resolve along with the integration process with NetSuite.