An overview of the lighting industry supply chain

The U.S. Department of Energy (DOE) recognizes increasing opportunities for domestic manufacturing of LED luminaires, particularly in high-end, niche products, and items that require quick lead times or manufacturing innovations. According to the LED Manufacturing Supply Chain report (published March 2021), 89% of the value in an LED troffer assembled in the U.S. directly benefits the U.S. economy, including parts, engineering, design, and shareholder profit. This highlights the significant economic contribution of domestic LED manufacturing to the nation's economy.

However, despite these opportunities, the LED lighting industry has faced notable supply chain disruptions, which are expected to persist in the coming years. These challenges have affected everything from raw material sourcing to production timelines, impacting both domestic and international markets. Additionally, the DOE report indicates that LED market penetration surpassed 50% in outdoor lighting by 2018, with projections suggesting that by 2035, 84% of all lighting sales will be LEDs. This shift presents a growing need for innovation and efficiency in the LED supply chain to meet increasing demand and maintain competitive advantage.

Beyond these disruptions, another factor to consider is the increasing push toward sustainability in manufacturing. As demand for energy-efficient products like LEDs rises, so does the focus on minimizing the environmental impact of the production process. Manufacturers who integrate sustainable practices into their supply chains and production methods will likely have a competitive edge in an increasingly eco-conscious market.

Global nature of supply chain and concentration of inputs coming from Asia

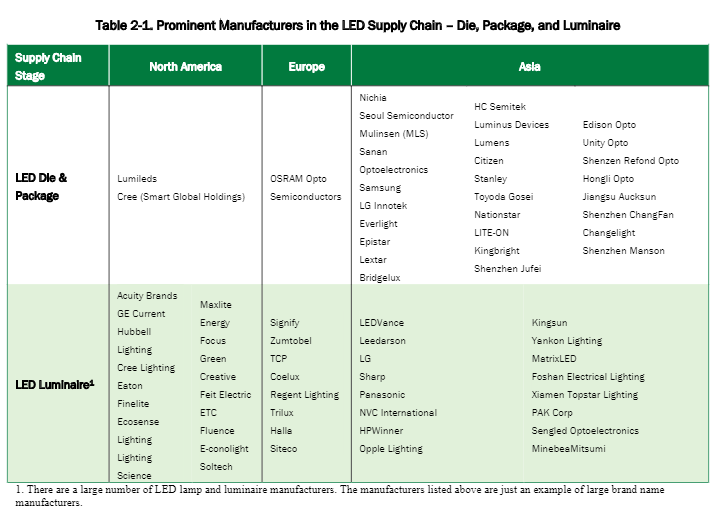

Because of the extensive components and production methods needed to produce LED lamps and luminaires, the supply chain really does span the globe. After acquiring supplies, the process involves driver manufacturing, LED luminaire manufacturing, LED package manufacturing, and LED die manufacturing. Every process (and even parts of a single process) may occur at different facilities in different countries.

Source: https://www.energy.gov/sites/default/files/2021-05/ssl-2020-led-mfg-supply-chain-mar21.pdf

Asia remains a key source for LED die and package manufacturing because its manufacturing costs are much lower than in other places. Specifically, China is a dominant source for LED packaging, and almost all epitaxy and wafer fabrication occurs in Asia.

But, it’s not all concentrated in Asia. In 2019, 21% of LED luminaire imports to the US were from Mexico. Other contributors included Germany, Japan, Malaysia, and Taiwan.

Variables that impact LED supply chain

The COVID-19 pandemic

There’s no question the pandemic negatively impacted the LED supply chain—especially in the first nine months. As China took major action to slow the spread of coronavirus, they shut down manufacturers which led to trickle-down impacts across the industry. We also saw delays in shipping, various shortages, and drops in demand.

Shipping delays and container availability

We’re seeing almost daily reports of crises at major container ports. At the end of September 2021, there were over 60 container ships waiting off the coast of Los Angeles. Delays are slowing the movement of both components and LED fixtures. There will continue to be negative impacts to the entire supply chain as a result.

While large retailers like Costco and The Home Depot are getting around some delays by contracting their own vessels, most businesses can’t access this type of workaround. Plus, the average cost of a container has increased 4x in 2021.

The American Lighting Association—along with other organizations—is pushing for new legislation around this. Changes might include regulations on ocean carriers, more oversight by the Federal Maritime Commission, minimum service standards, and moving the burden of proof for late fees to carriers (and away from companies placing orders). These changes may eventually improve supply chains, but progress remains distant.

Trade relations

We’re still seeing the impact of the previous administration’s tariffs on Chinese products. Generally, the increased costs from tariffs were passed down to American customers. Further, additional manufacturing has been offshored from the US to Mexico, but perhaps the biggest impact was the movement of production lines out of China and into countries like Malaysia and Vietnam.

Materials and labor availability

One of the primary drivers of shipping delays is labor shortages. In the summer of 2021, the Port of Oakland eliminated its backlog by hiring hundreds of additional workers. However, when containers do finally clear the port, their contents still need to be transported over land—another place where labor shortages are slowing down the supply chain.

We are seeing this play out at the Port of Los Angeles, where as of October 2021, there is a 2 week backlog of shipping containers waiting to access the port. While there are plenty of longshore workers available to unload the shipping containers, a shortage of truck drivers is creating a substantial chokepoint, which is expected to cause delays through the end of the year.

Supply chain’s effect on cash flow

As we’ve seen in the past 2 years, these variables cumulatively snowball and have a huge impact on costs and lead times.

Cost and time impacts

Reduced supply causes input prices to go up, putting a squeeze on margins and making cash flow of even greater importance.

Long lead times for products and inputs mean (of course) longer order fulfillment times. Meanwhile, businesses still need to keep their own lights on, pay staff, and cover upfront expenses while waiting to receive payment for invoices they processed. This is impacting almost all companies in the lighting/LED industry, and we’re hearing about substantial problems when it comes to LED drivers.

DSO (days sales outstanding) is beginning to increase dramatically. This compounds cash flow problems since money must still be committed to manufacturing upfront. It’s no wonder LED companies are starting to feel like they’re acting like banks or lenders!

How to solve for cash flow issues—without fixing the supply chain

In a perfect world, the supply chain would right itself expeditiously, input prices would decrease, and orders would be fulfilled in a reasonable amount of time. Businesses would get payment (in full!) before their bills are due, and cash flow problems would become a distant memory.

But we can’t fix the supply chain overnight. The solution we offer allows businesses to operate efficiently and continue to grow during these ongoing challenges.

Resolve is a complete B2B payments solution that bridges the payment delay between businesses and their customers. With Resolve, your customers get 30, 60, or 90 day net terms, and you get invoices paid in 1 day.

When it comes to problems created by supply chain breakdowns, Resolve is here to support businesses. We help manufacturers, wholesalers, and distributors manage their net terms and improve their cash flow. How? By allowing merchants to extend risk-free net terms, get paid up to 90% of each invoice within one day, and eliminate the headaches of managing every aspect of offering net terms, from credit decisions to accounts receivable tasks.

Resolve's end-to-end workflow software streamlines:

- Credit Checking: Terms eligibility & fast credit assessment

- Net Terms Enrollment: Immediately send net terms invoices

- Payment Collection: Invoice chasing and online portal for buyers

- Reconciliation: Syncs automatically with accounting systems

Get in touch with a member of our team today to discuss how we can help you navigate the trying supply chain issues the industry faces.