Launching GoMaterials to solve supply chain challenges in the landscaping industry

After running a landscape construction business for over 10 years, GoMaterials’ CEO, Marc Elliott, faced numerous challenges in sourcing and procuring the right materials. The struggles within the supply chain prompted Marc and his co-founders to create GoMaterials, a revolutionary B2B marketplace specifically designed for landscaping materials like wholesale plants, trees, and other essentials.

GoMaterials streamlines the landscaping procurement process by offering a one-stop platform for material estimation, quality assurance, and logistics management. This innovative solution helps businesses save time and reduce costs by connecting them directly with suppliers, making it easier to source materials efficiently and at competitive prices.

In addition to simplifying procurement, GoMaterials provides landscaping businesses with enhanced transparency and real-time updates on their orders. With a focus on customer service, the platform also offers personalized support to help businesses navigate the complexities of material sourcing. Whether you're managing a large-scale project or a small landscaping job, GoMaterials is designed to keep your operations running smoothly and cost-effectively.

Today, GoMaterials helps source millions of dollars in annual landscape material volume across Canada and the USA. However, this Canadian company wasn’t always available to its American customers.

Needing net terms to expand: an all-too-common challenge

GoMaterials had the chance at expanding the reach of their B2B marketplace into the large US market: taking on a large commercial landscaping company in the US would allow them to get a foothold in the country. In theory, this is every business founder’s dream—the chance to grow their company internationally, access new markets, and to take on coveted commercial and government contracts.

“In order to pursue those bigger customers, we needed to offer net terms.” -Bill Garnett, Head of Finance, GoMaterials

Hedging their bets: bigger customers in a new market without established credit

GoMaterials decided to go ahead with the contract while trying to find the right solution to offer net terms in the US. There were a few aspects that made this even more challenging. GoMaterials is a Canadian company and had only been working in the US for a few months before this opportunity came up. At the time of signing on the new customer, they had only been working on COD (cash on delivery) terms.

Additionally, large landscaping customers were reluctant to work on COD terms and preferred to operate strictly on net terms. If GoMaterials couldn’t offer net terms in the right currency for this new customer, they’d lose the contract.

Discovering Resolve as a solution to fuel sales growth

Traditional methods of offering net terms has flaws, but many companies accept this as the status quo. Companies usually take this process in-house and rely on lengthy customer credit checks that sometimes take weeks to finalize. Their process for finding out which businesses are credit-worthy (floating net terms is inherently risky) is often shaky. Old school credit checks require extensive time and effort from customers. Some businesses skip this process and offer net terms based on gut and intuition alone. Others offer net terms after an extensive credit checking process, only to end up with overdue accounts receivables from those same customers.

The next ‘best’ solution is usually invoice factoring—selling invoices to a third-party factoring company that would offer a set percentage of the invoice as a cash payout while keeping the business responsible for any unpaid invoices. However, factoring isn’t good for a company’s reputation or customer relationships - and the mechanics of factoring were not aligned with GoMaterials values as a company.

That’s when GoMaterials found Resolve. They noted that Resolve was inherently different than factoring and would allow them to uphold their strong relationships with customers. Resolve offered a quick and unobtrusive business credit check, called a “quiet credit check” that was often completed in just a few hours! GoMaterials was able to quickly partner with Resolve to set up the net terms they needed for their new American customer.

Using net terms to plant the seeds for growth

In order for GoMaterials to scale up their business it was strategically important to seek larger contracts. Which usually meant working with landscapers involved in commercial, city, or government projects. The ability to offer 30,60, or 90-day net terms was crucial to land these large customers.

Resolve was the right choice with their net-terms as a service offering.

How GoMaterials uses Resolve to grow while streamlining payment and financial operations

Outsourcing credit and risk management in a new market

With every customer GoMaterials needs to offer net terms to, they use Resolve to evaluate the customer’s credit and determine the credit line. With this information, GoMaterials is able to compete in a bigger market (the US) where net terms are a necessity. They also use Resolve to facilitate improved financial velocity through their 1-day 90% advance payments from invoices with net terms. Despite using Resolve as a “credit team on tap”, GoMaterials continues to be in complete control over its customer accounts. They select which customers and invoices they choose to run through Resolve, and whether to extend the full net terms that Resolve recommends.

Beyond net terms: processing and payments for all invoices (even due upon receipt)

Not all of GoMaterials’ customer accounts or invoices required net terms enrollment. However, Resolve’s invoicing and payment collections workflow was so easy to use, GoMaterials decided to use Resolve to process all their US-based customer invoices and payments, whether or not the invoice was on net terms.

The benefit of using Resolve as a consolidated one-stop shop for all its customers in the US?:

1. Consistent and simplified customer experiences

Before, GoMaterials’ accounting team would use two systems for sending invoices: Resolve for sending invoices on net terms, and QuickBooks Online for sending invoices that were due upon receipt. Customers weren’t able to access full visibility of their outstanding invoices in one platform. Now, US-based customers receive all their invoices through Resolve. This one-stop portal helps customers keep track of outstanding invoices and credit lines, while giving them the same enhanced payment and collection experience.

2. Operational efficiencies

By using Resolve for all their accounts receivables invoice management (invoices that both require net terms and are due on receipt), the entire financial workflow is now streamlined as invoices are processed through one system, Resolve, rather than two (Resolve and their accounting ERP, QuickBooks Online).

Paving the way for higher revenue

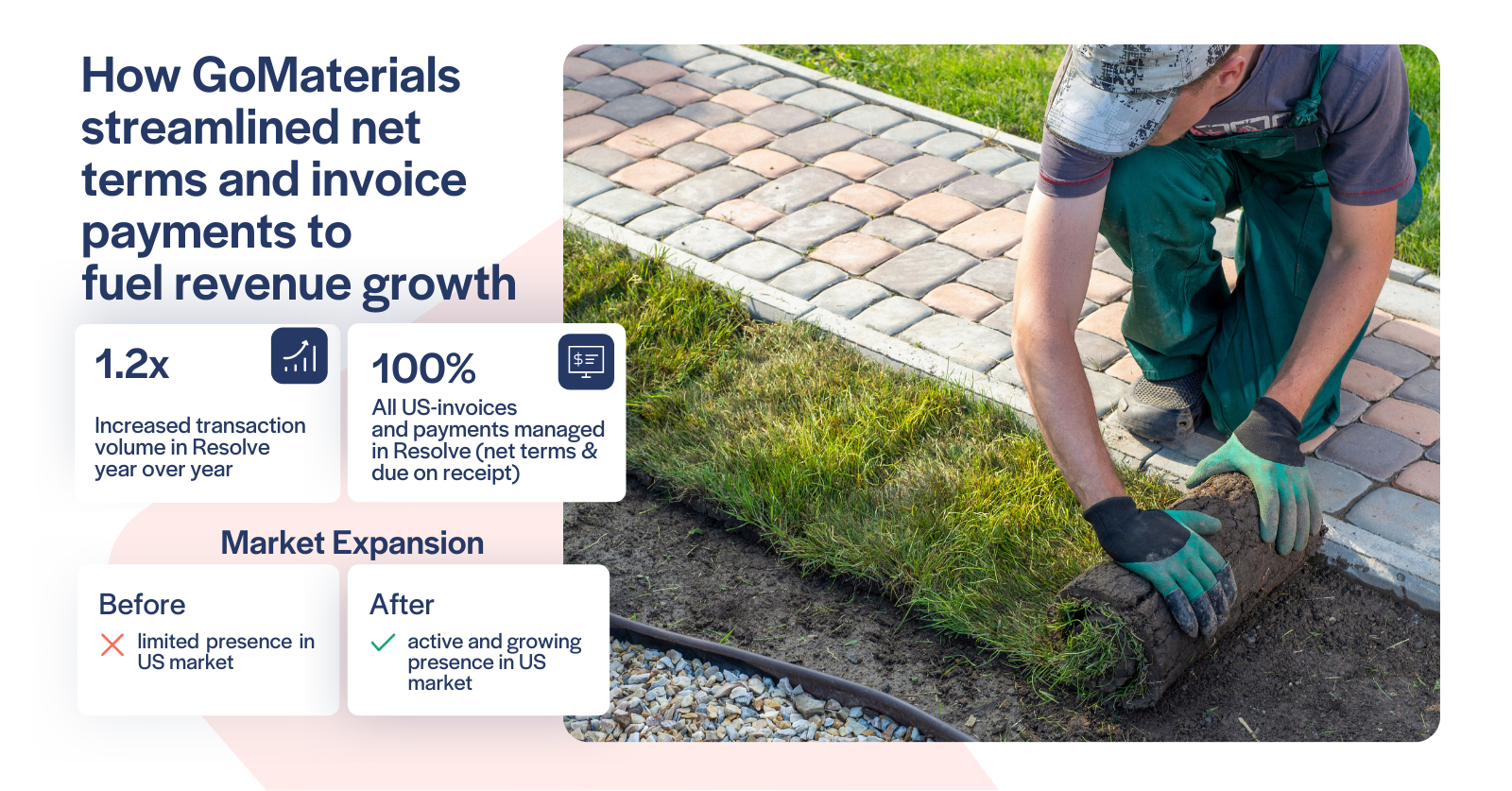

For GoMaterials, the numbers reveal what a difference Resolve has made. With Resolve, GoMaterials was able to rapidly set up their operations, which in turn helped them grow their revenue from the new market.

Of course, Resolve doesn’t take all the credit. GoMaterials is an ambitious and innovative company providing quality goods, excellent customer service, and offering an unique service for its customers. They’re working hard to build their business and consistently outperform themselves. But working on large commercial and government contracts requires excellent net terms. Resolve ensures that even smaller B2B companies can extend the net terms needed to seal the deal—while providing the cash these companies need to keep growing their business and serving their customers.

Improved negotiating power with suppliers

One fascinating advantage that GoMaterials received as a result of using Resolve was change in their relationship with their suppliers. Businesses love getting paid as soon as possible and suppliers are no different.

But when a business receives up to 90% of their accounts receivables one day after issuing invoices—and knows they can trust Resolve to consistently provide this financing—the financial situation changes. GoMaterials is now in a position where they can negotiate better terms with their suppliers. They know when they’re getting paid from their own clients through Resolve which empowers the purchasing process.

A growing partnership for business growth

GoMaterials needed a scalable solution and alternative to factoring that they could partner with as they expanded into the US. What began as a single contract to provide digital net terms for their first large US client has since turned into much more. GoMaterials now uses Resolve’s ‘quiet’ credit check to speed up the process of offering their customers net terms. They also now use Resolve for all their US-based accounts receivable invoices and payment processing, even if invoices do not require net terms or a cash advance.

With Resolve, GoMaterials was able to expand their network of suppliers into the US–and they continue to do so today. Year over year, the volume of transactions processed in Resolve increased by 1.2x. As they’ve expanded their vendors, they’ve also substantially expanded their customer base, both in the number of customers they’re adding and in the size of the contracts they’re closing. They are now available in Florida, Texas, New York, New Jersey, California, Georgia, and North and South Carolina–and continue to expand.

And that’s not where the growth and innovation ends. With global supply chain shortages, GoMaterials has become increasingly more valuable as businesses look for new ways to source and procure wholesale plant materials through GoMaterial’s growing marketplace of suppliers. With new partnerships, new vendors, and industry-leading education, GoMaterials continues to pave the way for plant procurement by becoming a true partner and extension of their customers’ team. And Resolve is excited to support this growth in a similar way. As GoMaterials’ outsourced team in the net terms, accounts receivables, and B2B payments arena, we cannot wait to see their continued expansion across the country.

Interested in learning how you can expand your business into new market through Resolve’s net terms and credit management solution? Read the story about DocShop Pro or learn more about our net terms management.