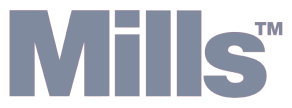

How does Resolve help manage net terms

& credit?

Resolve takes care of credit checking

Resolve puts an end to lengthy forms and manual reference checks. We'll approve your customers within 24 hours, and our decision is based on comprehensive financial data.

.png)

Increase & grow your B2B sales

Offering net terms to business buyers is proven to increase sales volume and sales frequency. Don't give your customers a reason to buy from anywhere else.

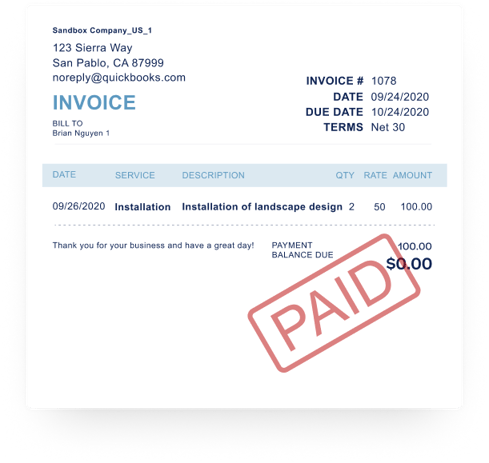

Improve cash flow, get paid 90% upfront

Get cash in the bank and fast. Resolve will advance pay up to 90% on invoices from your approved customers. Speeding up cash flow will transform the financial health of your business.

It's simple -

90%

Advance on invoices

30, 60, 90

Day net terms

1 day

Advance paid

3.5%

Resolve fee

How does Resolve work?

Resolve runs smart credit checks

Approved customers qualify for Advance Pay. This means up to 90% paid upfront on invoices. Higher risk customers may qualify for 75% or 50%.

Offer net terms to your customers

Resolve fees are 3.5% on 30 day net terms. Depending on your customer's expectations you can absorb this fee into your pricing - or pass it on to them.

We'll chase payments & collections

Resolve is like your 'credit team' or Accounts Receivable on tap. We send payment reminders and help chase late payments - if needed.

“Resolve has been like a spring… allowing us to grow and scale our B2B business more quickly than any other company. It’s been a catalyst to faster and better growth for us.”

Ray Gil

Account Executive at Hyperikon

We already manage the net terms for thousands of customers from these innovative companies