Grow your lighting manufacturing and wholesaling business with Resolve

Your business customers need 30 or 60 day net terms on orders. You need cash flow and reduced risk. Discover how to unlock growth & improve your b2b payment experiences. Resolve will increase your customer's order sizes and frequency. We already work with manufacturing businesses such as Archipelago Lighting, Allstyle LED, Vision Lighting, LED My Place, WEN Lighting, and Ikio LED Lighting (and many more).

We already unlock net terms for thousands of companies

Resolve helps you offer net terms & expand your business

Make it easier for your customers to buy

By offering net terms, your customers are more likely to purchase from you, purchase larger amounts, and purchase more often. It's win-win, when you give your customers more time to pay, you're helping their business succeed too.

.png?width=662&height=710&name=Group%201225%20(1).png)

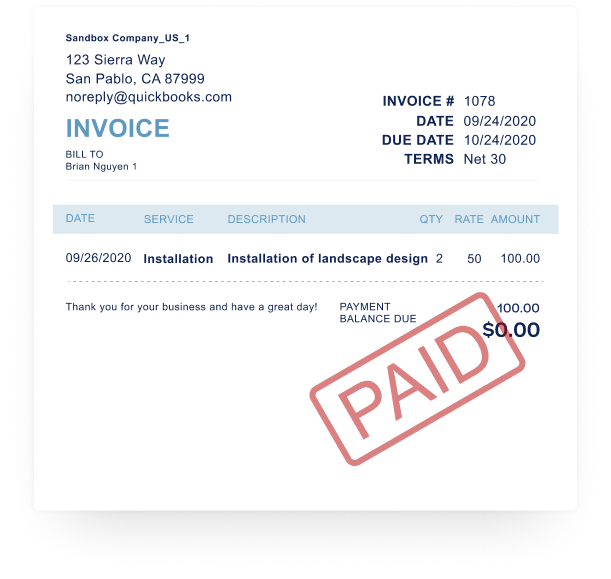

Get paid faster on net terms invoices

Resolve will pay your qualifying customer's invoices within 1 day - they'll get 30, 60, or 90 days to pay us. Depending on your customer's credit results, you'll get up to 90% of the invoice paid upfront.

Remove the risk of 'floating' terms

Get cash in the bank and fast. Resolve will advance pay up to 90% on invoices from your approved customers. If your customer doesn't pay, the risk is on Resolve not your business. Resolve is non-recourse financing.

.png?width=446&height=550&name=3.%20Send%20Invoice%20(2).png)

It's simple -

90%

Of your customer invoice advanced

1 day

Advance is paid to your account

30, 60, 90

Day net terms for approved customers

2.61%

On 30 day net terms & 90% advance rate

How does Resolve work?

Resolve runs smart credit checks

Resolve runs 'quiet' credit checks, and approved customers qualify for Advance Pay. This means up to 90% paid upfront on invoices.

Offer risk-free net terms

Don't float your own net terms program. Resolve is non-recourse financing (i.e. risk-free to you). Resolve fees are 2.61% on 30 day net terms.

Improved customer payments

Resolve's 'grey labeled' payments portals means your customers still feel like they're dealing with you. We take care of processing payments.

“ I've been regularly seeing much larger orders with Resolve than I would have otherwise seen without net payment terms, which has been a huge win for our wholesale business. ”

Account Executive at On Demand Tires