Grow Revenue with BNPL for B2B

Resolve helps you increase cash flow by giving you advance payment when you offer buy now pay later (BNPL) and net terms to your B2B customers.

| Get up to 100% cash up front within 1 business day | |

| Get 5 free credit checks on your top customers | |

| Resolve handles invoicing, payments, and collections |

Built and backed by the world's leading FinTech brands

15,000+ Merchants trust Resolve

Built for Large-Scale Product Businesses

Our financing solutions are specifically designed for distributors, Suppliers, wholesalers, and manufacturers

moving high-value physical goods in volume.

Manufacturing

Equipment manufacturers, industrial machinery producers, and large-scale component suppliers with established product lines.

Distribution

Wholesale distributors and supply chain operators handling bulk orders with proven inventory management systems.

Material Goods

High-volume suppliers of tangible products with clear cost-of-goods, inventory tracking, and established fulfillment processes.

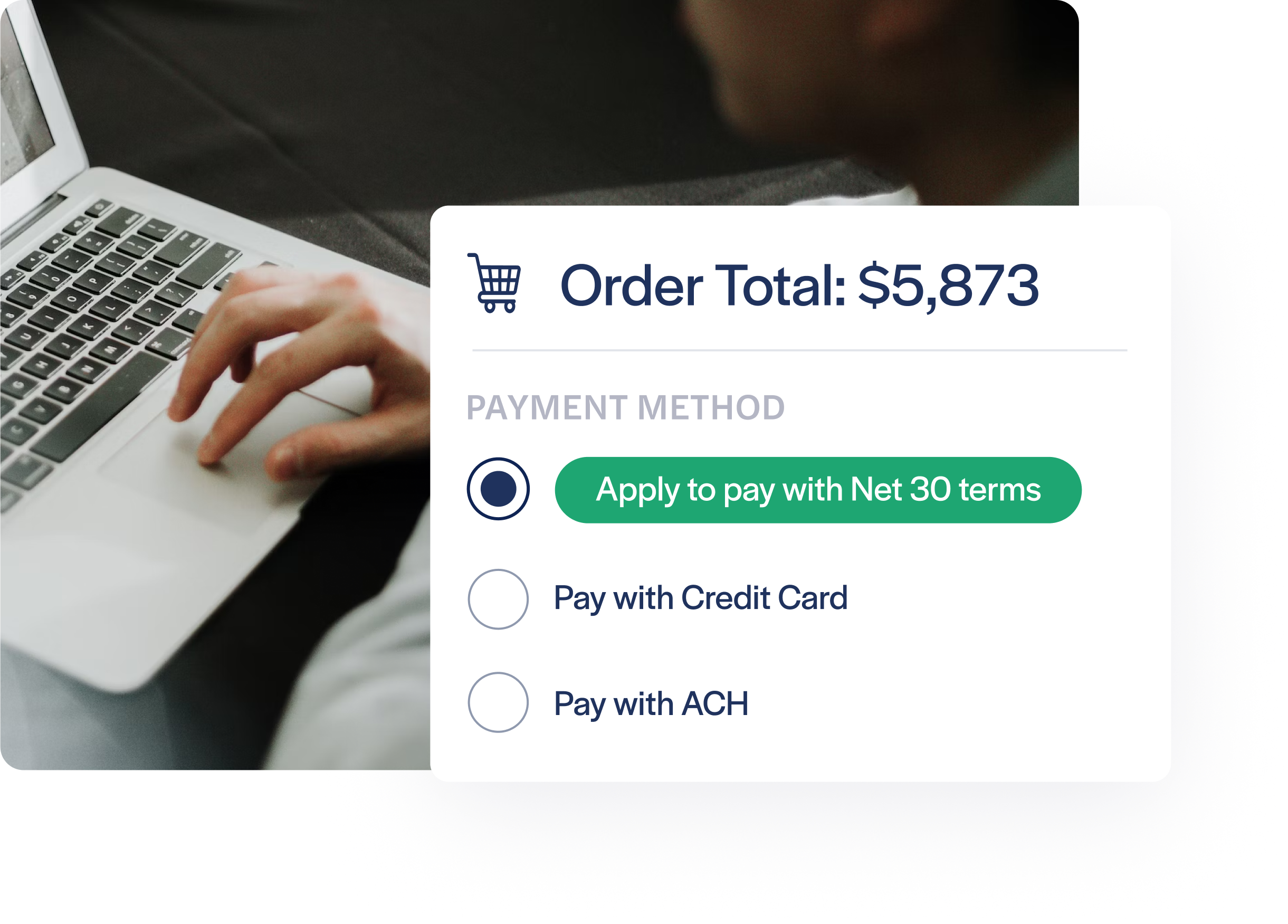

Sell more with Buy Now Pay Later

Simple ecommerce integrations

How Docshop Pro Built a Modern Online Marketplace with Resolve

"Resolve has positively impacted our cash flow. Their advance on each invoice we submit, has translated into quicker receivables, directly contributing to healthier cash flow management."

Luke Elliot

Co-Founder

"It's been a breath of fresh air. Response times under 24 hours on credit approvals. We hear so often how customers are taken aback at how quick we respond confirming a decent sized line."

John Ibbetson

VP of Sales & Business Development

"If you do not have the size, scale, or core competency to manage AR and net terms in-house, Resolve is the absolute best alternative that will allow you to white label and integrate this experience into your business and process. Resolve pays for itself."

Sylvia Ruma

VP of Operations

“Resolve is like a customer satisfaction solution as they make it so easy for our customers to pay, there is an option for everyone."

John Sanzone

CEO

"Resolve worked with us along the way to understand our needs and managed to fully automate a 2-way integration. Now, the work required from our end has decreased by at least 90%."

Rima Bouhaidar

Accounting Manager